Modest Improvements in Demand, Lending Conditions for Real Estate Loans During Q4 2023

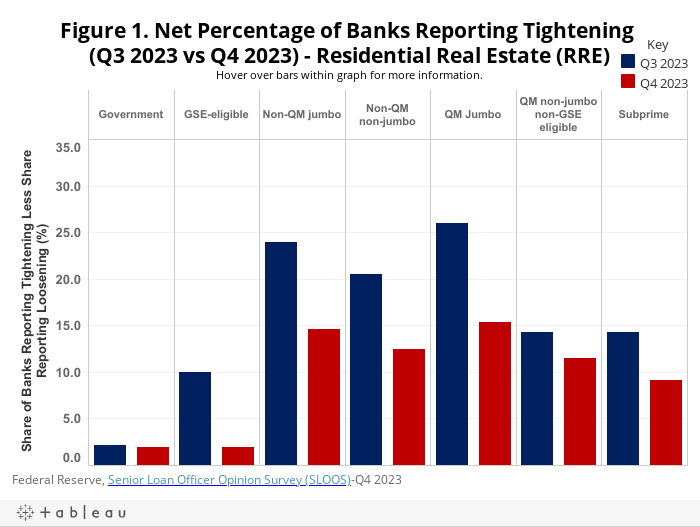

Eric Lynch2024-02-12T13:15:13-06:00According to the Federal Reserve Board’s January 2024 Senior Loan Officer Opinion Survey (SLOOS), lending standards loosened for all commercial real estate (CRE) loan categories and residential real estate (RRE) categories in the fourth quarter of 2023. Demand for RRE and CRE loans improved across all categories over the quarter, except for government loans. Even though the federal funds rate remained unchanged, the shifting expectations from the Federal Reserve toward rate cuts is having an impact on sentiment among major lending institutions. A higher net percentage of banks reported looser residential mortgage lending standards in Q4 2023 compared to Q3 2023 for all categories of RRE loans. The largest improvement occurred for Qualified Mortgage (QM) jumbo which fell 10.6 percentage points from 26.0% in Q3 2023 to 15.4% in Q4 2023. GSE-eligible, Non-QM jumbo, and Non-QM non-jumbo experienced decreases of at least 8 percentage points quarter-over-quarter. All RRE categories saw increases in loan demand, except for government loans which saw a 0.4 percentage points decline from Q3 2023 to Q4 2023. Subprime experienced a dramatic quarterly shift: it had the weakest demand in Q3 2023 (-71.9%) but rose almost 30 percentage points to become the strongest demand category for RRE in Q4 2023 at -41.7%, relatively speaking. The remaining five RRE categories had demand increases by single-digits quarter-over-quarter. Compared to Q4 2022, all RRE categories increased the share of banks reporting stronger minus weaker demand by at least 30 percentage points. Both multifamily loans as well as all CRE construction and development loans, on net, saw modest improvements in lending conditions from Q3 2023 to Q4 2023. Construction & development experienced the share of banks reporting tightening conditions fall 25.2 percentage points to 39.7%. Multifamily improved by 24.8 percentage points to 40.7% in Q4 2023. Fifty percent of banks reported weaker demand for loans secured by multifamily properties and 46.6% for construction & development loans; This is slightly more positive compared to Q3 2023, where both categories were greater than 50%. Year-over-year, demand for construction & development improved 15.5 percentage points compared to Q4 2022 whereas multifamily experienced a small decrease (-0.7 percentage points). ‹ The Age of the U.S. Housing StockTags: ad&c loans, commercial real estate loans, credit, credit standards, Federal Reserve, GSE, lending, lending conditions, loan demand, loans, monetary policy, mortgage finance, real estate loans, residential real estate loans, sloos, subprime