Mortgage Rates Hold Steady Despite Modest Uptick in Treasury Yield

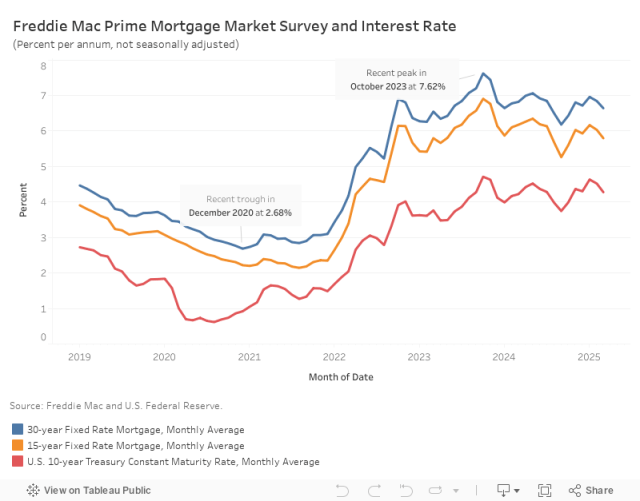

Catherine Koh2025-06-26T15:15:46-05:00Average mortgage rates were flat in June, according to Freddie Mac. The average 30-year fixed-rate mortgage held at 6.82%, while the 15-year stayed at 5.95%. Compared to a year ago, the 30-year rate is down 10 basis points (bps), and the 15-year rate is 24 bps lower. The 10-year Treasury yield, a benchmark for long-term borrowing, averaged 4.43% in June – a marginal increase of 5 bps from the previous month. However, the most recent weekly yield saw a small decrease following Federal Reserve Chair Jerome Powell’s congressional testimony, where he noted the possibility of a rate cut being “sooner rather than later” if inflation remains contained. Nonetheless, he reiterated the Fed’s “wait and see” stance, citing ongoing uncertainty around how changes in trade, immigration, fiscal, and regulatory policies will affect the economy. Last week, the Federal Open Market Committee (FOMC) continued its pause on rate cuts, keeping the federal funds rate unchanged at 4.25% to 4.5%. The updated dot plot continues to signal a cumulative rate cut of 50 bps by the end of 2025. However, the latest Summary of Economic Projections revised the median 2025 GDP forecast down from 1.7% to 1.4%. Forecasts for unemployment (4.4% to 4.5%), PCE inflation (2.7% to 3.0%), and core PCE inflation (2.8% to 3.1%) were all revised upward. Discover more from Eye On Housing Subscribe to get the latest posts sent to your email.