Fed Decision: Shifting Expectations toward Future Rate Cuts

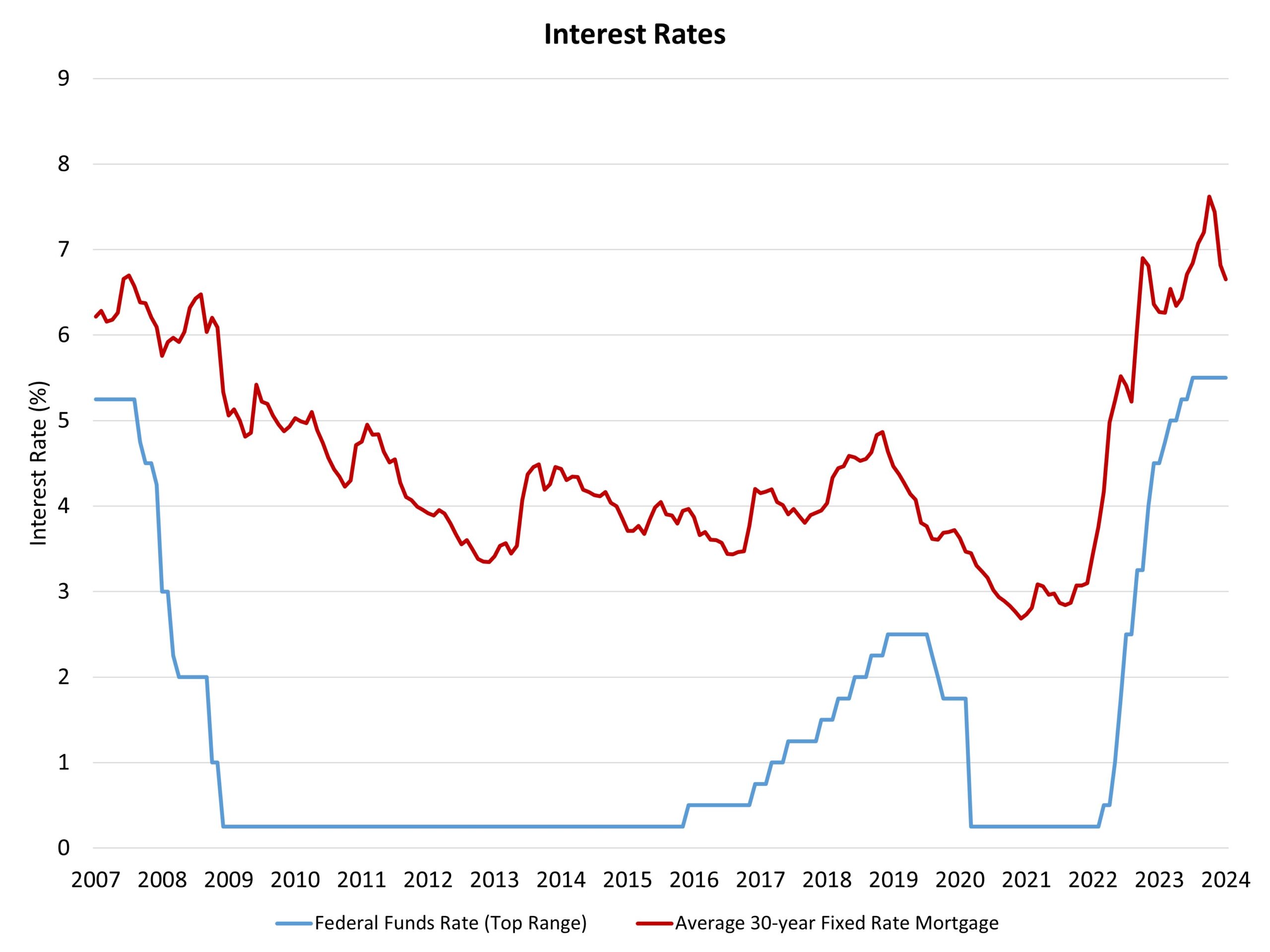

Robert Dietz2024-01-31T15:15:32-06:00The Federal Reserve’s monetary policy committee held the federal funds rate constant at a top target of 5.5% at the conclusion of its January meeting. The Fed will continue to reduce its balance sheet holdings of Treasuries and mortgage-backed securities as part of quantitative tightening and balance sheet normalization. Marking a fourth consecutive meeting holding the federal funds rate constant, the Fed is now setting the ground for rate cuts later in 2024. With inflation data moderating (although still elevated) and limited slowing of labor market conditions, markets and some analysts are expecting a federal funds rate cut as soon as March. In contrast, NAHB’s forecast includes rate cuts beginning no earlier than June due to ongoing strong economic conditions. Today’s decision does not alter this outlook. The January Fed statement suggests the central bank is now in a holding pattern, with crosswinds between six months of declines for inflation rates but still present solid economic conditions. Recent indicators suggest that economic activity has been expanding at a solid pace. Job gains have moderated since early last year but remain strong, and the unemployment rate has remained low. Inflation has eased over the past year but remains elevated. Ongoing, current elevated rates will continue to place downward pressure on inflation as the economy progresses to the Fed’s target of 2% over the course of 2024 and 2025. However, as inflation comes down, nominal interest rates can be reduced in order to maintain constant yet still restrictive monetary policy. With an eye toward future Federal Reserve policy action, the Fed appears to be set for rate cuts later in 2024, but the commentary below suggest that the first cut will not come in March due to solid employment conditions and a low unemployment rate. The Committee judges that the risks to achieving its employment and inflation goals are moving into better balance. As we have noted with prior Fed announcements, the central bank missed an opportunity in its statement to cite the outsized role shelter inflation has played in recent CPI reports. Chair Powell did note that activity in the housing market was “subdued” during his opening statement at today’s press conference. He also indicated that he expects slower rent growth will, eventually, help the overall inflation picture. However, the high cost of development and home construction is slowing the fight against inflation by keeping residential supply constrained. State and local governments could assist the fight against inflation by addressing the root causes of these rising costs. Looking forward, the Fed’s prior December economic projections suggest three rate cuts in 2024. While the federal funds rate will move lower later this year, the Fed will continue reducing its balance sheet, thereby maintaining an elevated spread between the 10-year Treasury rate and rates for 30-year fixed rate mortgages. The 10-year Treasury rate, which partially determines mortgage rates, dipped below 4% after today’s Fed announcement. Mortgage rates will continue to register in the high 6% range, but below the 8% level housing markets experienced last October. Mortgage rates should move lower as 2024 progresses. ‹ Homeownership Rate Dips to 65.7% Amid Housing Affordability WoesTags: economics, FOMC, home building, housing