Higher Rates and Lack of Supply Continue to Hamper Mortgage Market

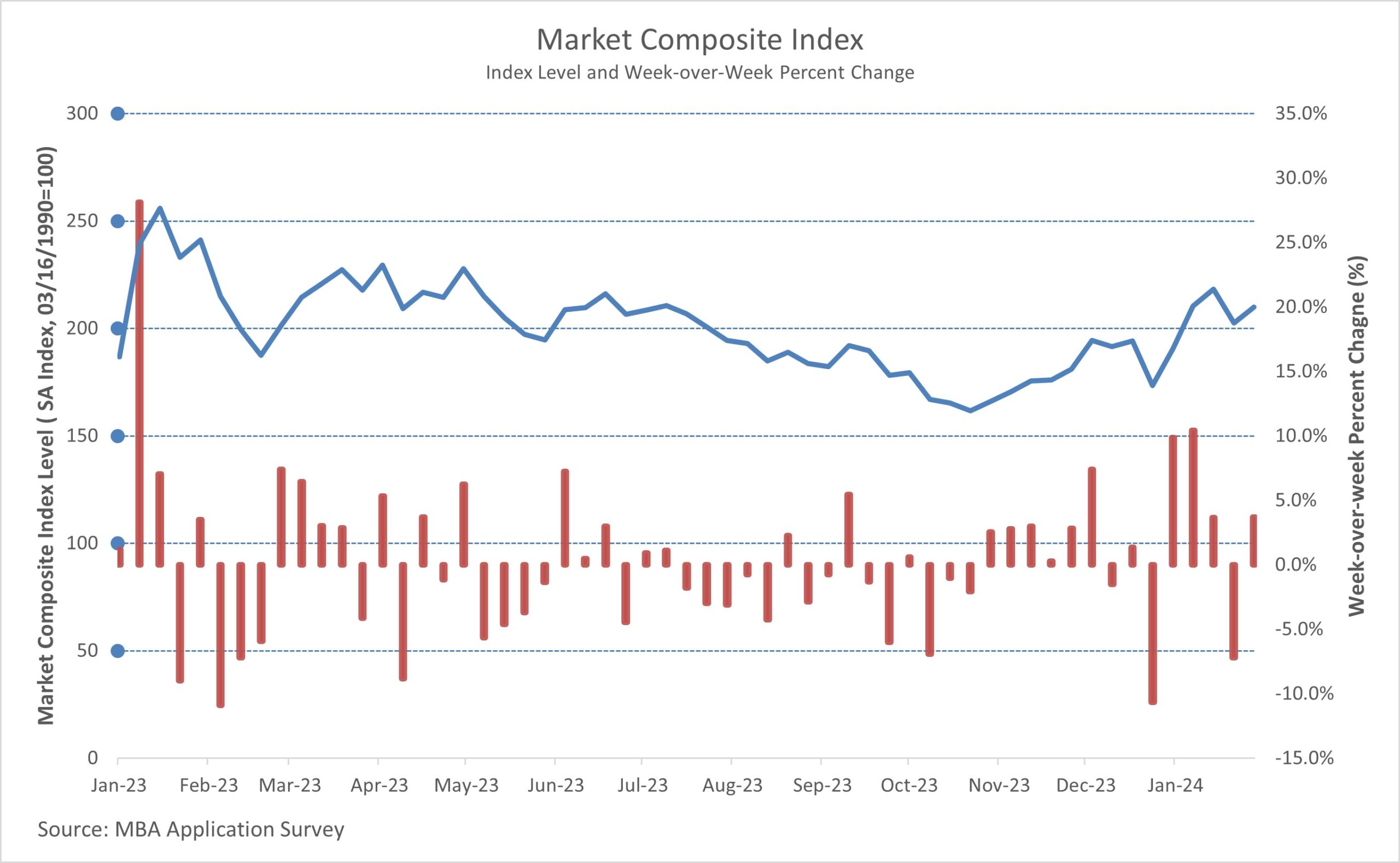

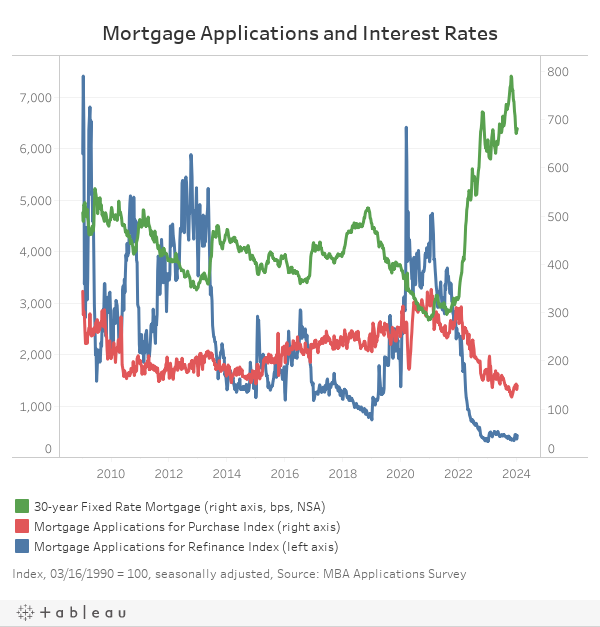

Jesse Wade2024-02-07T10:19:56-06:00By Jesse Wade on February 7, 2024 • Per the Mortgage Bankers Association’s (MBA) survey through the week ending February 2nd, total mortgage activity increased 3.7% from the previous week, and the average 30-year fixed-rate mortgage (FRM) rate rose two basis points to 6.80%. The 30-year FRM has floated around 6.8% for much of the start of the year, only moving one basis point from January. Total mortgage activity is 12.9% lower than last year. One reason for this is the 30-year FRM was at a relatively lower level of 6.18% last year. The Market Composite Index, a measure of mortgage loan application volume, rose by 3.7% on a seasonally adjusted (SA) basis from one week earlier. Purchasing activity fell 0.7% and refinancing activity increased 12.3% week-over-week. Purchasing activity was 18.6% lower than one year ago, and refinancing activity was up 0.7% from one year ago. The refinance market has remained dull due to most homeowners having lower rates than the current levels, while in the purchase market the lack of housing supply continues to hamper potential buyers. The refinance share of mortgage activity rose from 34.2% to 35.4% over the week, while the adjustable-rate mortgage (ARM) share of activity fell from 6.6% to 6.4%. The average loan size for purchases was $434,800 at the start of February, up from $421,800 over the month of January. The average loan size for refinancing decreased from $273,500 in January to $270,500 in February. The average loan size for an ARM was up at the start of February to $949,200, while the average loan size for a FRM rose to $337,300. ‹ Homeownership Rates by Race and EthnicityTags: finance, interest rates, mba, mortgage applications, mortgage bankers association, mortgage lending, refinancing