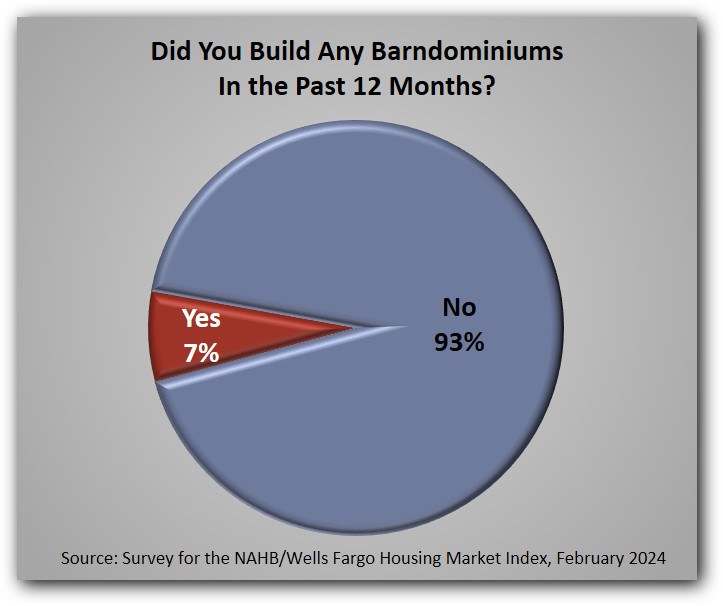

Seven Percent of Builders Now Build Barndominiums

Paul Emrath2024-03-01T11:15:15-06:00By Paul Emrath on March 1, 2024 • Over the past decade, use of the term “barndominium” (indicating a structure that is, in some sense, a combination barn and condominium) has become increasingly widespread in real estate media outlets. In fact, the term has become popular enough for NAHB to include a question about it in its survey for the February 2024 NAHB/Wells Fargo Housing Market Index. In response to that survey, a total of 7% of single-family builders reported that they did, indeed, build barndominiums sometime during the past 12 months. That result, however, leaves open the question of what a builder means by a barndominium. Unlike a term with a consistent definition maintained by, say, an academic organization or government agency, “barndominium” has meant different things to different reporters over the years. When the term was first gaining popularity, reporters were usually using it to describe a metal frame structure that was used as a primary residence. But that usage has been far from consistent. When NAHB’s builders were asked about the type of barndominiums they built, the vast majority (70%) indicated that their barndos were a combination of residential space and a large shop area—a criterion that doesn’t even consider the structure’s framing. The percentages referring to framing-based criteria were smaller but still significant: 30% of builders reported that their barndos were a combination of traditional residential and post-frame construction, and 26% said they were post-framed residential structures with sheet metal siding (26%). Only 9% said their barndos were created by actually converting a barn into a primary residence. Whichever of these techniques a builder uses, the result of creating a barndominium is a new housing unit which, in the typical jurisdiction, requires a residential building permit. ‹ Young Adults Living with Parents: State DifferencesTags: barndo; barndominium, economics, home building, housing