Is U.S. Lumber Self-Reliance Possible?

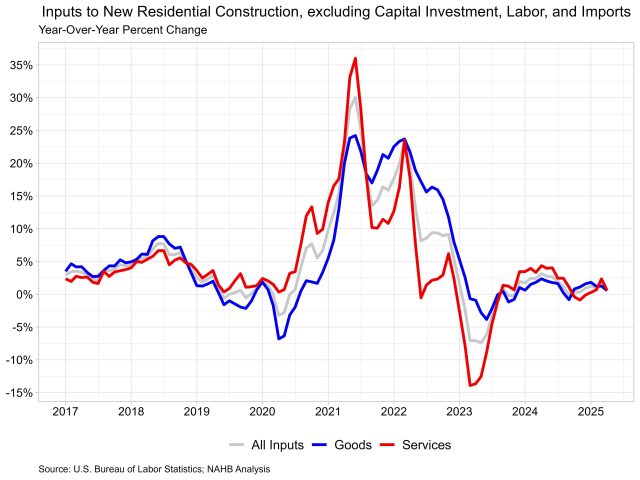

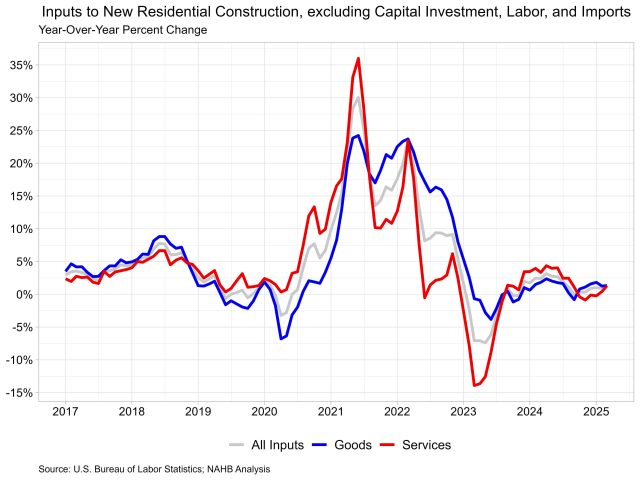

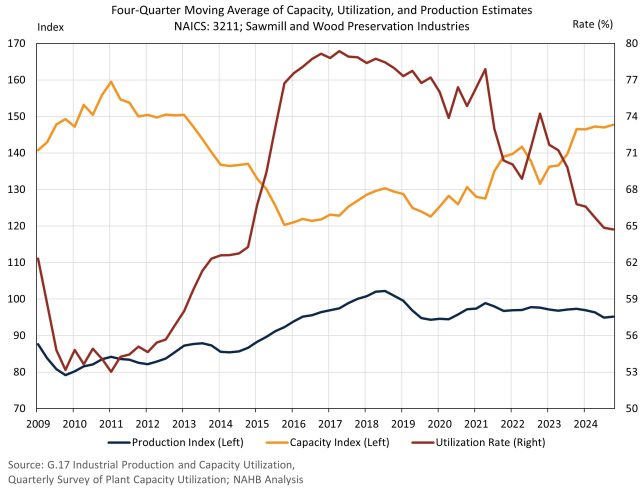

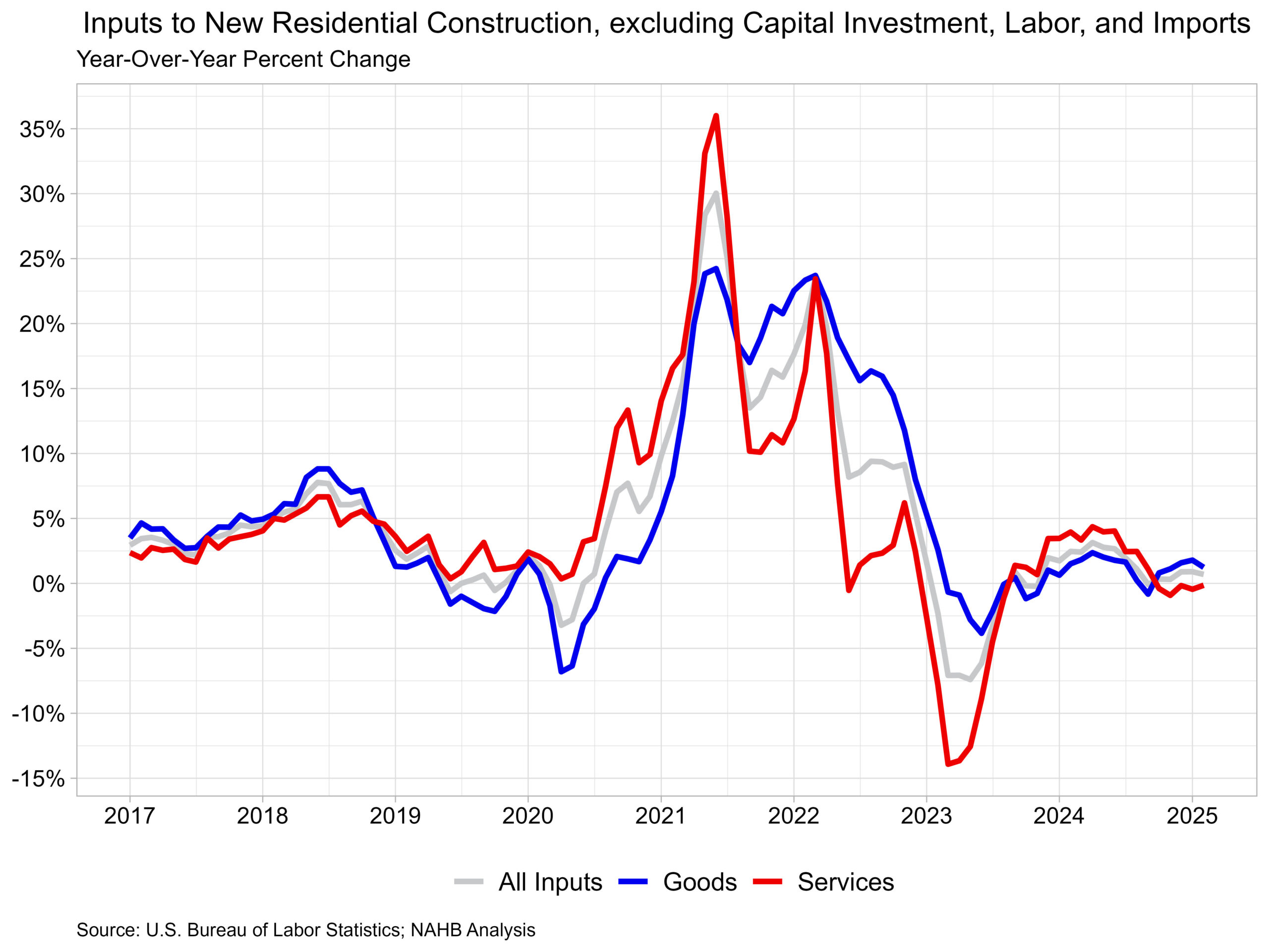

Jesse Wade2025-06-24T10:19:11-05:00Lumber cost uncertainty has risen from the start of the year, driven in part by potential higher tariffs, particularly on Canadian softwood lumber. Despite the continued use and threat of tariffs, U.S. sawmill and wood preservation firms have not increased production to a level that replaces imports. In fact, utilization rates continue to fall, meaning they have the capacity to produce more lumber but are simply not operating at that level. As these firms produce at lower levels, their employment has fallen over the past few quarters. At the same time, reduced foreign competition and artificially higher prices have lessened the incentive for firms to expand output, even as demand remains high. As a result, U.S. mills remain unable to meet the nation’s full lumber consumption needs. In the first quarter of 2025, sawmill and wood preservation firms continued to report lower capacity utilization coupled with stagnant production. The utilization rate, a ratio of actual production and potential production, was 64.4% in the first quarter on a four-quarter moving average basis. The utilization rate has continued to drop since 2017, as capacity (or the capability to produce) has increased, but production has remained lower than in 2018. By combining the Federal Reserve’s production index and the Census Bureau’s utilization rate, we can compose a rough index estimate of what the current production capacity is for U.S. sawmills and wood preservation firms. Shown below is a quarterly estimate of the calculated production capacity index with production index and utilization rate estimates. Based on the data above, sawmill capacity has increased from 2015 but remains lower than peak levels in 2011. Most of the recent capacity gains took place in 2023, followed by little gain over the course of 2024. As evident above, there is ample room to increase production of domestic lumber, but current production levels remain much unchanged over the past several years. Looking at the Producer Price Index, lumber prices remain higher than 2024. At current pricing levels, producers may see no benefit of increasing output, as it would push prices lower since demand has fallen from the start of the year. Notably, even when prices were historically high in 2021 and 2022, producers were unable to increase their production significantly during these periods, potentially due to supply chain disruptions. Employment at sawmills and wood preservations firms fell again in the first quarter to 88,533 workers. This marks the third consecutive quarter where employment fell in this industry. Tariff policies to protect the U.S. lumber industry have been in place since 2017 in the form of antidumping/countervailing duties. Tariff policies are typically intended to provide stability to the industry and increase employment but here, we are seeing the opposite effect. These policies specifically place duties on imports of Canadian softwood lumber, where nearly a quarter of the U.S. softwood lumber supply originates. The current AD/CVD rates on Canadian softwood lumber are expected to double this fall to over 30%. Due to U.S. lumber production remaining level since the initial tariff policies were enacted in 2017, doubling these duty costs will likely not increase supply but simply increase costs. Discover more from Eye On Housing Subscribe to get the latest posts sent to your email.