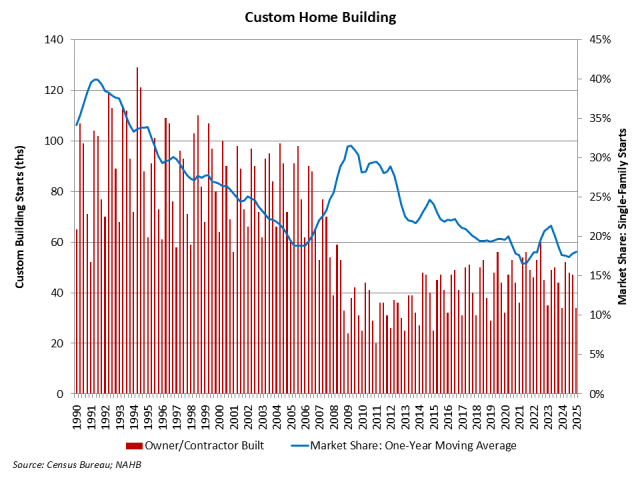

Flat Custom Home Building Trends

Robert Dietz2025-05-19T08:18:02-05:00NAHB’s analysis of Census Data from the Quarterly Starts and Completions by Purpose and Design survey indicates flat year-over year growth for custom home builders. The custom building market is less sensitive to the interest rate cycle than other forms of home building but is more sensitive to changes in household wealth and stock prices. There were 34,000 total custom building starts during the first quarter of 2025. This was unchanged relative to the first quarter of 2024. Over the last four quarters, custom housing starts totaled 181,000 homes, just more than a 2% increase compared to the prior four quarter total (177,000). Currently, the market share of custom home building, based on a one-year moving average, is approximately 18% of total single-family starts. This is down from a prior cycle peak of 31.5% set during the second quarter of 2009 and the 21% recent peak rate at the beginning of 2023, after which spec home building gained market share. Note that this definition of custom home building does not include homes intended for sale, so the analysis in this post uses a narrow definition of the sector. It represents home construction undertaken on a contract basis for which the builder does not hold tax basis in the structure during construction. Discover more from Eye On Housing Subscribe to get the latest posts sent to your email.