Construction Job Openings Rise as Total Economy Count Falls

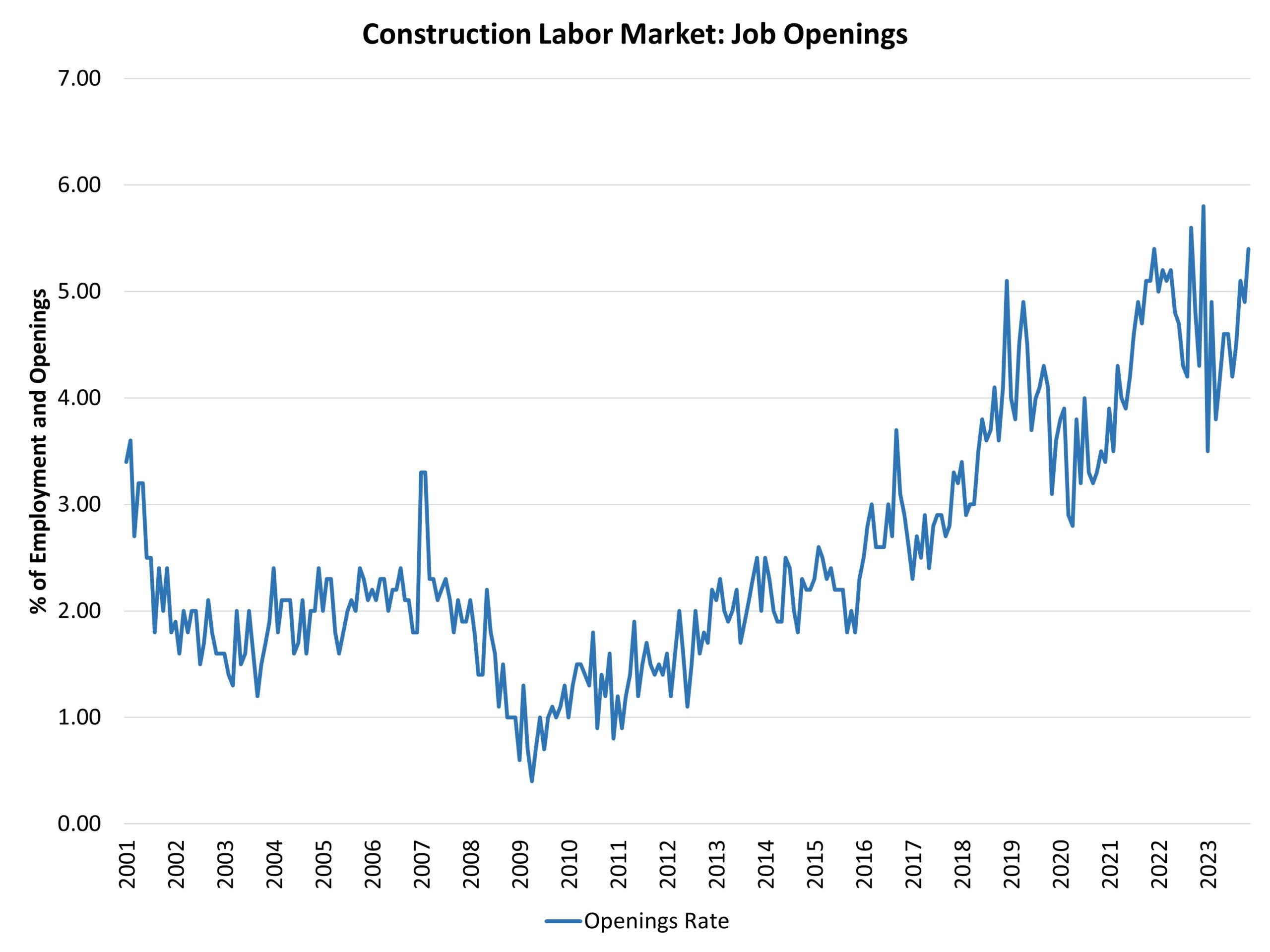

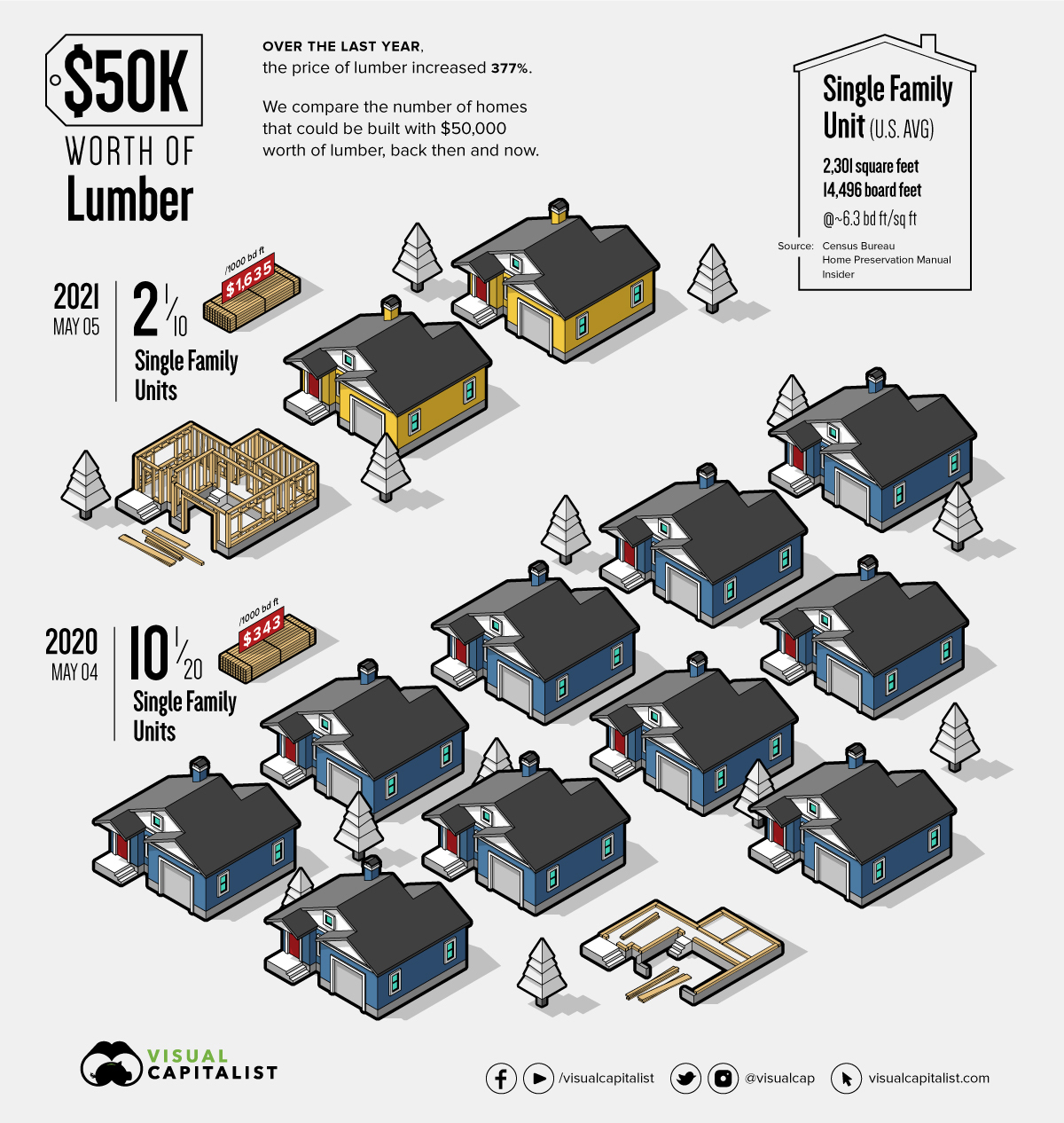

Robert Dietz2024-01-03T10:22:06-06:00Due to tightened monetary policy, the count of total job openings for the economy continues to move slower. This is consistent with a cooling economy that is a positive sign for future inflation readings. In November, the number of open jobs for the economy declined to 8.8 million. This is notably lower than the 10.8 million reported a year ago. NAHB estimates indicate that this number must fall back below 8 million for the Federal Reserve to feel more comfortable about labor market conditions and their potential impacts on inflation. While the Fed intends for higher interest rates to have an impact on the demand-side of the economy, the ultimate solution for the labor shortage will not be found by slowing worker demand, but by recruiting, training and retaining skilled workers. This is where the risk of a monetary policy mistake can arise. Good news for the labor market does not automatically imply bad news for inflation. The construction labor market moved in the opposite direction of the overall economy, with the number of open construction jobs rising. The count of open construction jobs increased to 459,000 in November after a revised reading of 416,000 in October. The count was 348,000 a year ago, during a period of housing market cooling. The recent rise indicates an ongoing skilled labor shortage for the construction sector. These estimates come after a data series high of 488,000 in December 2022. The construction job openings rate increased to 5.4% November. The recent gains for construction job openings reflect the ongoing skilled labor shortage. The housing market remains underbuilt and requires additional labor, lots, and lumber and building materials to add inventory. Hiring in the construction sector decreased to a 4.5% rate in November after 4.7% in October. The post-virus peak rate of hiring occurred in May 2020 (10.4%) as a post-covid rebound took hold in home building and remodeling. Construction sector layoffs were steady at a 2.1% rate in November after 2% in October. In April 2020, the layoff rate was 10.8%. Since that time, the sector layoff rate has been below 3%, with the exception of February 2021 due to weather effects and March 2023 due to some market churn. Looking forward, attracting skilled labor will remain a key objective for construction firms in the coming years. While a slowing housing market will take some pressure off tight labor markets, the long-term labor challenge will persist beyond the ongoing macro slowdown. ‹ November Gains for Private Residential Construction SpendingTags: economics, home building, housing, JOLTS, labor market