State/Local Property Tax Revenue Share Falls for Third Straight Quarter

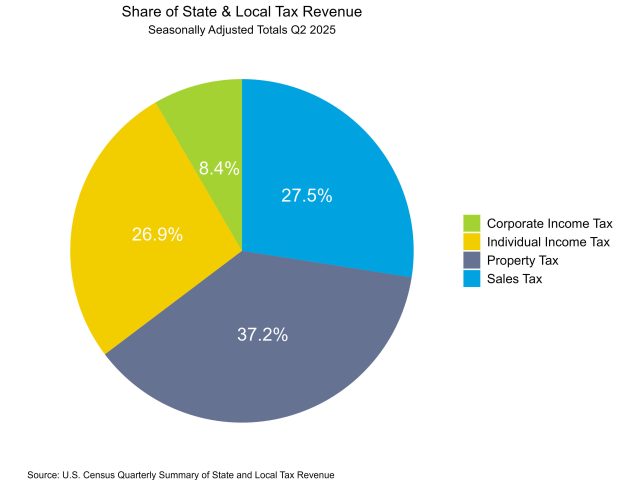

Jesse Wade2025-09-26T08:18:57-05:00In the second quarter of 2025, property tax revenue for state and local governments recorded a new high, although it decreased as a share of total tax revenue. . On a seasonally adjusted basis, state and local government property tax revenue grew 0.7% over the quarter, according to the Census Bureau’s quarterly summary of state and local tax revenue. Meanwhile, total tax revenue for state and local governments increased 1.6% over the quarter, with individual income tax revenue up 4.1%, sales tax revenue up 0.8% and corporate income tax revenue up 0.5%. Property tax revenue stood at $203.4 billion in the second quarter, a slight increase from a revised $202.0 billion estimate in the first quarter. These collections increased 2.5% from one year ago. While this shows growth over the quarter, the share of state and local governments tax revenue originating from property tax fell for the third consecutive quarter. The share is down from its recent peak of 38.0% in the third quarter of 2024 to 37.2%, a 0.8 percentage point decline. Property taxes typically make up the largest share of the total tax revenue for state and local governments, accounting for over one-third at 37.2% in the second quarter. The second highest generator was sales tax at 27.5%, totaling $150.0 billion, followed closely by individual income tax at 26.9% ($146.9 billion). Corporate income tax rounded out the remaining 8.4% at $45.8 billion. Discover more from Eye On Housing Subscribe to get the latest posts sent to your email.