Adjustable-Rate Mortgage Applications Rise

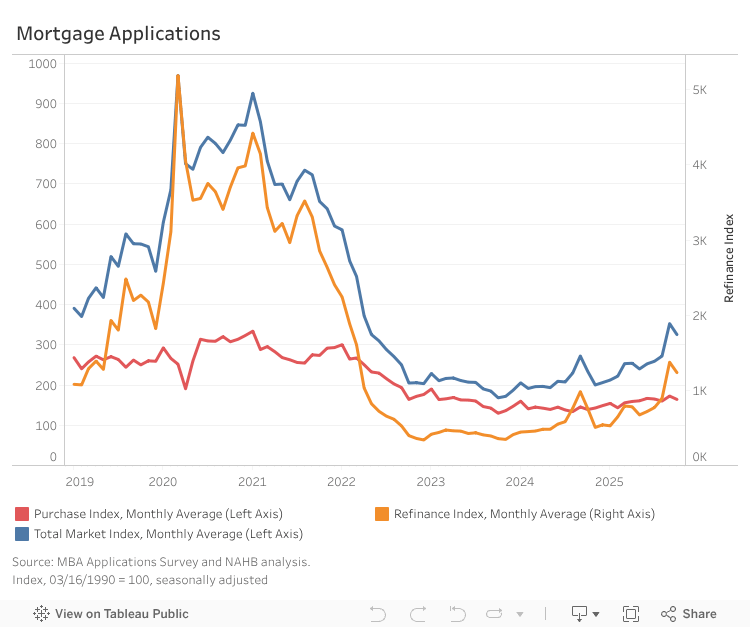

Web Master2025-11-12T13:14:21-06:00All types of mortgage activity rose on a year-over-year basis in October, supported by recent declines in interest rates. Notably, adjustable-rate mortgage (ARM) applications more than doubled from a year ago, and refinancing activity continued to strengthen. The Mortgage Bankers Association’s (MBA) Market Composite Index, a measure of total mortgage application volume, fell 7.7% from September on a seasonally adjusted basis but was 39.0% higher than a year ago. The average contract interest rate for 30-year fixed mortgages fell 5.4 basis points to 6.37%, the lowest in over a year. Following a strong increase in September, refinancing activity in October dropped 10% month over month, while purchase applications decreased 4.8%. Compared to a year ago, purchase and refinance applications were up 18.1% and 63.0%, respectively. By loan type, fixed-rate mortgage applications decreased 7% from September but were 34% higher year-over-year. Adjustable-rate mortgage applications dropped 13% month-over-month, yet surged 116.5% from a year earlier, following a 124% annual gain in September. As a result, ARMs accounted for 9.44% of total applications in October, one of the highest shares in the past three years. The average loan size across all mortgages was $408,000, down 3% from the previous month. The average purchase loan size remained steady at $437,000, while the average refinance loan size declined 6% to $385,000. For adjustable-rate mortgages, the average loan size fell 5% to $938,000, compared to a 2% decline for fixed-rate mortgages to $353,000.