The Fed Cuts and Projects More Easing to Come

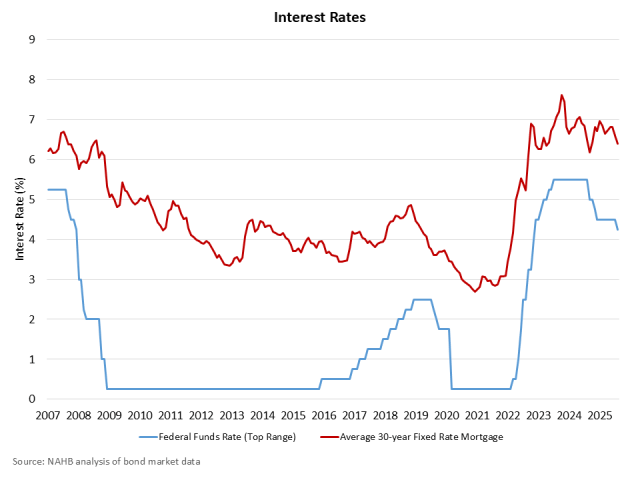

Web Master2025-09-17T15:15:58-05:00After a monetary policy pause that began at the start of 2025, the Federal Reserve’s monetary policy committee (FOMC) voted to reduce the short-term federal funds rate by 25 basis points at the conclusion of its September meeting. This move decreased the target federal funds rate to an upper rate of 4.25%. Economically, the cut is justified given signs of a softening labor market and moderate inflation readings. However, Chair Powell characterized today’s easing as a “risk management cut,” rather than one driven by fundamental changes in the economic outlook. NAHB is forecasting another 75 basis points of easing in the coming quarters, with 25 of that total coming before the end of the calendar year. The Fed announced no changes to its ongoing balance sheet reduction policy. While the Fed is easing on the short-end of the yield curve, the ongoing quantitative tightening (QT) program is still exerting upward pressure on mortgage interest rates and is partially responsible for the elevated spread of mortgage rates over the 10-year Treasury rate. The Fed’s balance sheet has contracted from almost $9 trillion in May 2022 to $6.6 trillion in September. A hypothetical slowing of QT for mortgage-backed securities would reduce mortgage interest rates, perhaps by 25 basis points. The Fed summarized current economic conditions as follows: “Recent indicators suggest that growth of economic activity moderated in the first half of the year. Job gains have slowed, and the unemployment rate has edged up but remains low. Inflation has moved up and remains somewhat elevated.” The FOMC statement also indicated that uncertainty about the outlook remains “elevated.” Given the size of recent employment revisions, it might be worth noting that both the outlook and some of the current data reporting is uncertain. Chair Powell noted in his press conference that activity in the housing market remains “weak,” consistent with recent data for the home building sector. He also noted that “housing was at the center monetary policy.” Powell once again noted that a housing shortage exists that lies beyond monetary policy, alluding to the challenges builders face from issues like regulatory cost burdens. The September FOMC policy decision was expected by markets, given recent communication from the Fed, including Chair Powell’s remarks at the Jackson Hole monetary policy conference. For this reason, much of the effect of today’s decision was already priced into long-term interest rates, including a decline for the average of the 30-year fixed rate mortgage. This rate has declined by 20 basis points to 6.35% over the last month, per Freddie Mac. In fact, the 10-year Treasury rate barely moved in response to today’s announcement. A growing risk for long-term rates, including mortgage rates, comes from federal government debt and deficits. In contrast to movement for long-term rates, the reduction of the federal funds rate will have a direct, beneficial effect on interest rates for acquisition, development and construction loans, the key financing channel for private builders who build more than 60% of single-family homes. This will reduce lending costs for builders across the nation and enable more attainable supply. There was considerably more internal drama entering today’s FOMC decision. Besides marking a resumption of Fed easing, today’s meeting featured newly installed Fed Governor Stephen Miran and the participation of embattled Governor Lisa Cook. It is worth noting that Miran was the only dissenter at today’s meeting. Instead of voting for a 25-basis point cut, Miran preferred a 50-basis point reduction. That said, today’s decision featured less division among the FOMC voting members than some analysts expected, which is a positive with respect to the Fed’s independence. A revised Summary of Economic Projections (SEP) was also published today. The SEP provides a view of Fed Governors’ and Federal Reserve Bank Presidents’ outlook for economic conditions, inflation expectations and future monetary policy actions (only 12 of the 19 SEP respondents are voting members at each meeting). While there was little dissension in today’s FOMC policy decision, the SEP reveals considerable disagreement for the outlook. Seven SEP respondents projected no additional cuts for the remainder of the year. Twelve projected more cuts. The median projection suggests two more rate cuts for 2025. One respondent, most likely Governor Miran, provided an outlook of five more 25 basis point cuts before the end of 2025. On a median basis, the Fed sees weaker economic growth ahead. The SEP reports a 1.6% GDP growth rate (measuring the 4th quarter to 4th quarter change) for 2025, 1.8% in 2026 and 1.9% in 2027. The SEP projection reports only small increase in the unemployment rate, with a peak rate ahead of 4.5% ahead. For the median SEP respondent, the economy is not seen as reaching the target 2% core CPE inflation rate until 2028. It is worth noting that prior editions of the SEP also saw this target as effectively two years away. Nonetheless, while taking longer than previously expected, the otherwise declining trend for expected inflation in the years ahead suggests the Fed sees any possible tariff effects on inflation will be one-off or otherwise limited, as Governor Waller in particular has explained. Overall, today’s decision was widely expected. Much of the benefit of today’s easing was already priced into long-term interest rates, but the rate cut will benefit business loan finance conditions. Further, additional rate cuts lie ahead, although as Chair Powell noted, “policy is not on a pre-set course.” Future Fed actions will depend on incoming data and the evolving policy environment. Discover more from Eye On Housing Subscribe to get the latest posts sent to your email.