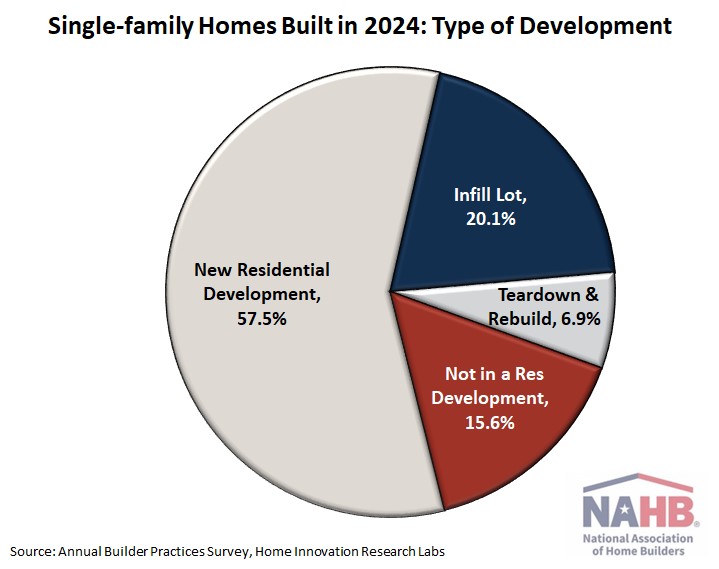

About 7% of New Homes Are Teardowns

Paul Emrath2025-12-01T10:15:52-06:00In 2024, 6.9% of new single-family detached homes were teardowns (structures torn down and rebuilt in older neighborhoods), and another 20.1% were built on infill lots in older neighborhoods, according to the latest Builder Practices Survey (BPS) conducted by Home Innovation Research Labs. The BPS places new homes in one of four development categories. In addition to teardown and infill, the categories include “new residential development” and ”not in a residential development.” Homes built in a new residential development (i.e., subdivisions) are by far the most common type. There is a moderate amount of geographic variation in the teardown share. At the high end, over one in ten single-family homes were built on a lot where a structure had to be torn down in three of the nine Census Divisions: 15.0% in New England, 13.2% in the Pacific, and 10.1% in the East South Central. At the low end, the teardown share was only 4.8% in the South Atlantic. Nationally, homes built in older neighborhoods, but without tearing down another structure first, were nearly three times as common as teardowns. Again, however, there is geographic variation. Infill development accounted for over 30% of single-family homes in New England (38.0%) and the Middle Atlantic states (32.4%) but accounted for under 10% in the West South Central (9.7%) and Mountain (9.3%) divisions.