Retreat for Single-Family Built-for-Rent Housing

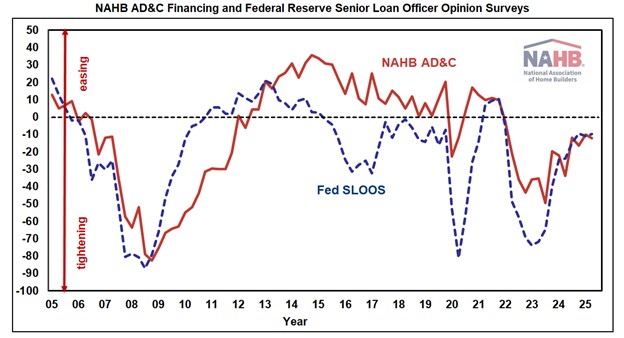

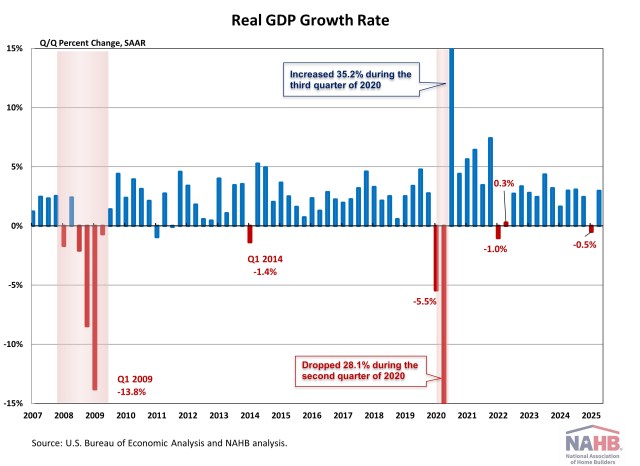

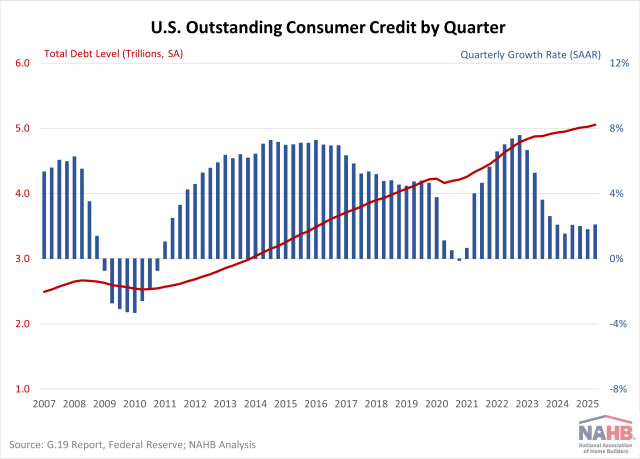

Robert Dietz2025-08-20T11:14:43-05:00Single-family built-for-rent construction fell back in the second quarter, as a higher cost of financing crowded out development activity. According to NAHB’s analysis of data from the Census Bureau’s Quarterly Starts and Completions by Purpose and Design, there were approximately 12,000 single-family built-for-rent (SFBFR) starts during the second quarter of 2025. This is down significantly relative to the second quarter of 2024 (25,000 starts). Over the last four quarters, 71,000 such homes began construction, which is a 16% decrease compared to the 85,000 estimated SFBFR starts in the four quarters prior to that period. The SFBFR market is a source of inventory amid challenges over housing affordability and downpayment requirements in the for-sale market, particularly during a period when a growing number of people want more space and a single-family structure. Single-family built-for-rent construction differs in terms of structural characteristics compared to other newly-built single-family homes, particularly with respect to home size. However, investor demand for single-family homes, both existing and new, has cooled with higher interest rates. Given the relatively small size of this market segment, the quarter-to-quarter movements typically are not statistically significant. The current four-quarter moving average of market share (7%) is nonetheless higher than the historical average of 2.7% (1992-2012). Importantly, as measured for this analysis, the estimates noted above include only homes built and held by the builder for rental purposes. The estimates exclude homes that are sold to another party for rental purposes, which NAHB estimates may represent another three to five percent of single-family starts based on industry surveys. The Census data notes an elevated share of single-family homes built as condos (non-fee simple), with this share averaging more than 4% over recent quarters. Some, but certainly not all, of these homes will be used for rental purposes. Additionally, it is theoretically possible some single-family built-for-rent units are being counted in multifamily starts, as a form of “horizontal multifamily,” given these units are often built on a single plat of land. However, spot checks by NAHB with permitting offices indicate no evidence of this data issue occurring. With the onset of the Great Recession and declines for the homeownership rate, the share of built-for-rent homes increased in the years after the recession. While the market share of SFBFR homes is small, it has clearly expanded. Given affordability challenges in the for-sale market, the SFBFR market will likely retain an elevated market share. However, in the near-term, SFBFR construction is likely to slow until the return on new deals improves. Discover more from Eye On Housing Subscribe to get the latest posts sent to your email.