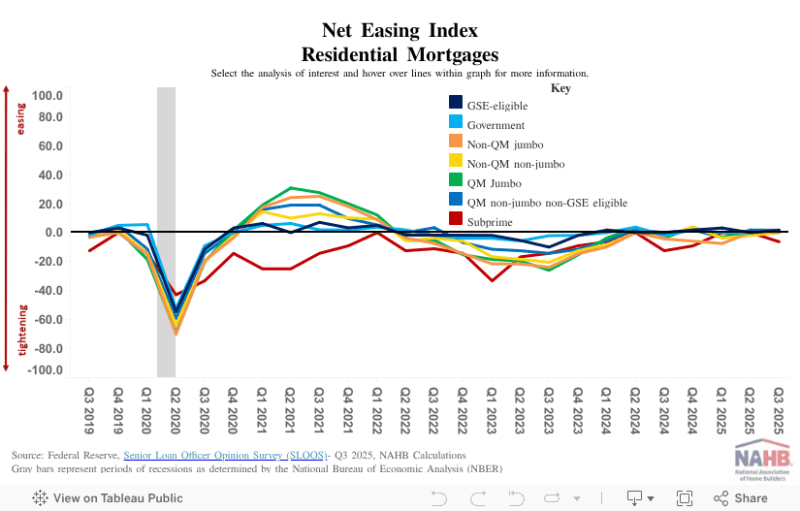

Unchanged Lending Conditions for Residential Mortgages in Third Quarter

Eric Lynch2025-11-13T08:14:35-06:00Lending standards for most types of residential mortgages were essentially unchanged, according to the recent release of the Senior Loan Officer Opinion Survey (SLOOS). For commercial real estate (CRE) loans, lending standards for construction & development were modestly tighter, while multifamily was essentially unchanged. Demand for both CRE categories was essentially unchanged for the quarter. Two weeks ago, the Federal Reserve eased its key short-term interest rate (i.e., Federal Funds) by 25 basis points for the second consecutive meeting, establishing an upper bound of 4.00%. While the causal link between the Federal Funds rate and the 30-year fixed rate mortgage is minimal, these cuts will have a more tangible impact for private home builders through lower rates on acquisition, development, & construction (AD&C) loans. Roughly 60% of single-family starts are built by private builders. With pressure from both sides of their dual mandate as the job market cools and inflation remains sticky, NAHB is forecasting a measured approach from the Fed when it comes to further rate cuts next year. Residential Mortgages In the third quarter of 2025, four of seven residential mortgage loan categories saw a positive net easing index for lending conditions with an additional two recording a neutral reading (i.e., 0). Only subprime loans experienced tighter lending conditions, as evidenced by a negative value (-6.3). Nevertheless, based on the Federal Reserve classification of any reading between -5.0 and +5.0 as “essentially unchanged,” all but subprime fell within this range. Five of the seven residential mortgage loan categories reported stronger demand in the third quarter of 2025, with the strongest demand coming from Government, GSE-eligible, and Qualified Mortgage (QM) non-jumbo, non-GSE eligible loans. Non-QM jumbo was essentially unchanged for the quarter, while subprime loans were the only category to experience weaker demand, which has been the case since Q3 of 2020. Commercial Real Estate (CRE) Loans For the CRE loan categories, construction & development loans registered a net easing index of -6.6 for the third quarter of 2025, indicating modestly tighter credit conditions. For multifamily loans, the net easing index was -1.6, or essentially unchanged. Both categories of CRE loans show tightening of lending conditions (i.e., net easing indexes below zero) since Q2 2022. However, the tightening has become less defined recently for multifamily, with its net easing index essentially unchanged (i.e., between -5.0 and +5.0) for four consecutive quarters. The net percentage of banks reporting stronger demand was -4.9% for construction & development loans, with a negative number indicating weaker demand. For multifamily, demand was neutral (i.e., 0) in the third quarter of 2025, with the same number of banks that reported weaker demand as those who reported stronger demand. However, demand for CRE loans within both categories has experienced unchanged conditions (i.e., between -5.0% and +5.0%).