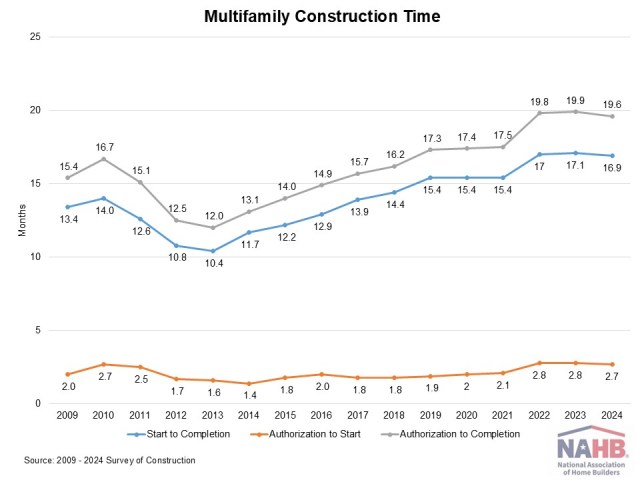

Shorter Apartment Construction Time in 2024

Web Master2025-10-06T09:14:42-05:00The average time needed to complete construction of a multifamily building after obtaining authorization edged down in 2024, according to the 2024 Survey of Construction (SOC) from the Census Bureau. On average, it took 19.6 months from permit to completion, about 0.3 months shorter than in 2023. While construction timelines remain lengthy, this modest decline occurred despite the industry continuing to grapple with a shortage of skilled labor. The average time to build multifamily homes varies with the number of units in the building. In general, the more units, the longer the construction time. In 2024, buildings with 20 or more units took the longest, 22.1 months, to build after obtaining authorization. By contrast, 2-to-4-unit buildings were finished the fastest, averaging 15.3 months. Mid-sized projects fell in between, with 10-to-19-unit buildings averaging 19.2 months and 5-to-9-unit buildings averaging 19.1 months. Year-over-year changes show a mixed pattern. Completion times for 2-to-4-unit buildings shortened by 2.3 months, while 10-to-19-unit projects took 2.3 months longer. The biggest increase occurred for 5-to-9-unit buildings, which required 2.2 more months to complete than in 2023. The 2024 SOC data also show a significant regional variation in the average construction duration of multifamily buildings. The Northeast had the longest time from authorization to completion at 23.4 months, followed by the West at 19.9 months, and then the South with 18.5 months. The shortest permit-to-completion period happened in the Midwest with 17.3 months. Discover more from Eye On Housing Subscribe to get the latest posts sent to your email.