Top 10 Builder Market Share Across Metros

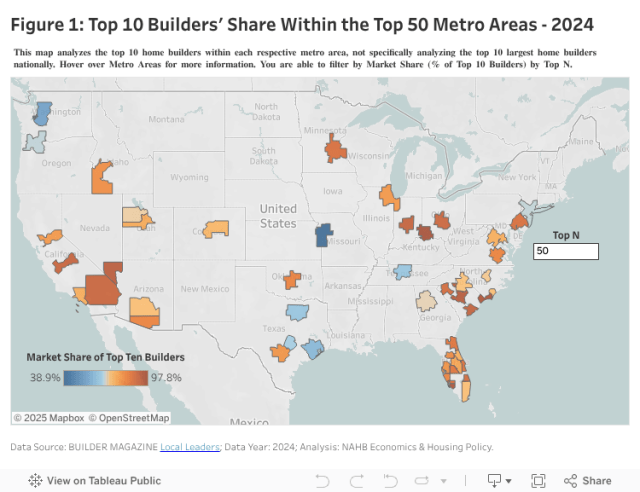

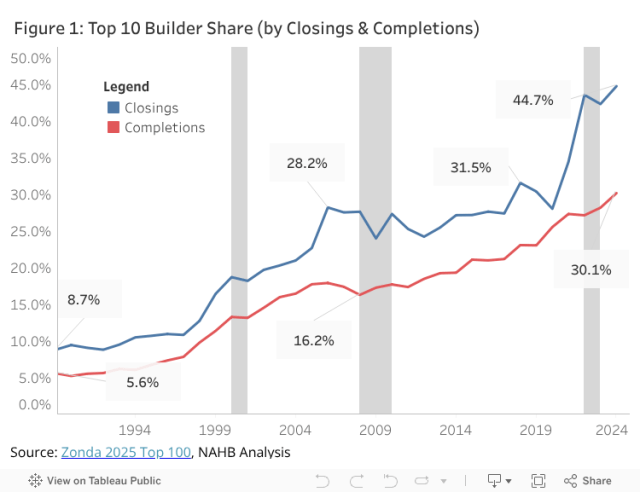

Sarah Caldwell2025-07-22T08:15:58-05:00An earlier post described how the top 10 builders1 in the country captured a record 44.7% of new single-family closings in 2024. BUILDER Magazine has now released additional data on the top ten builders within each of the 50 largest new home markets in the U.S., ranked by single-family permits. It is important to note that this post does not focus on the top ten largest home builders nationally; instead, it analyzes the top ten list within each of the largest 50 new housing markets. The 2024 data show that the top 10 builder concentration in the 50 largest markets ranged from 38.9% in Kansas City, MO-KS to 97.8% in Cincinnati, OH. In 11 metro areas, the top ten builders’ market share exceeded 90%. Across all 50 metro areas, the average market share of the top 10 builders was 79.3%, up from 78.2% in 2023. Looking at the results on a map reveals that southern California, South Carolina, Florida, and parts of the Midwest include multiple highly concentrated markets, while Texas and the Northwest include markets with lower levels of concentration (figure 1). Lennar and D.R. Horton each made the top ten builder list in 46 markets, the most among all builders. PulteGroup was next with 36 metro markets, followed by NVR and Meritage Homes with 22 and 20 metro markets, respectively. From 2023 to 2024, 27 metro areas saw an increase in their top 10 builders’ market share, compared with 36 increases from 2022 to 2023. Seven metro areas experienced a double-digit increase in 2024: Oklahoma City, OK (+20.7 percentage points, 82.8%) Atlanta-Sandy Springs-Alpharetta, GA (+14.7 percentage points, 76.8%) Punta Gorda, FL (+11.5 percentage points, 85.9%) Philadelphia-Camden-Wilmington, PA-NJ-DE-MD (+10.7 percentage points, 87.5%) Greenville-Anderson, SC (+10.6 percentage points, 89.3%) Salt Lake City, UT (+10.5 percentage points, 69.8%) Charleston-North Charleston, SC (+10.4 percentage points, 92.3%) Meanwhile, 20 metro areas saw a decline in their top 10 builders’ market share from 2023 to 2024, up from only 9 decreases from 2022 to 2023. The largest decreases were seen in: Miami-Fort Lauderdale-Pompano Beach, FL (-18.1 percentage points, 72.4%) Los Angeles-Long Beach-Anaheim, CA (-14.7 percentage points, 75.6%) Orlando-Kissimmee-Sanford, FL (-11.6 percentage points, 76.8%) Tucson, AZ (-10.4 percentage points, 82.4% Of the remaining three largest markets, Cape Coral-Fort Myers, FL saw no change in its top ten builder concentration (96.2%) from 2023 to 2024, while Fresno, CA and Spartanburg, SC are new to the top 50 market list in 2024. Only builders who build for-sale units are included in the ranking. Discover more from Eye On Housing Subscribe to get the latest posts sent to your email.