Weaker Demand for Residential Mortgages in Second Quarter

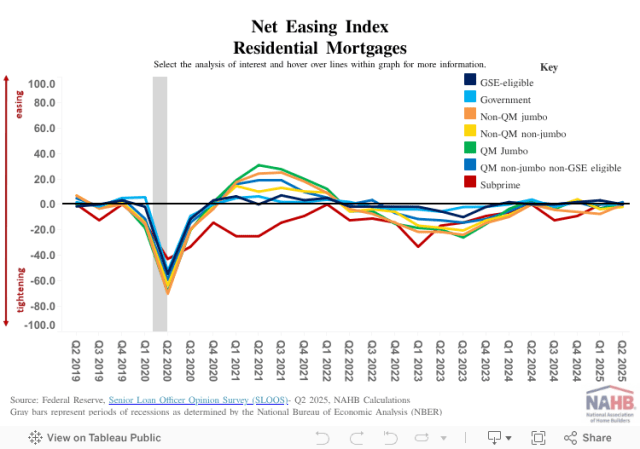

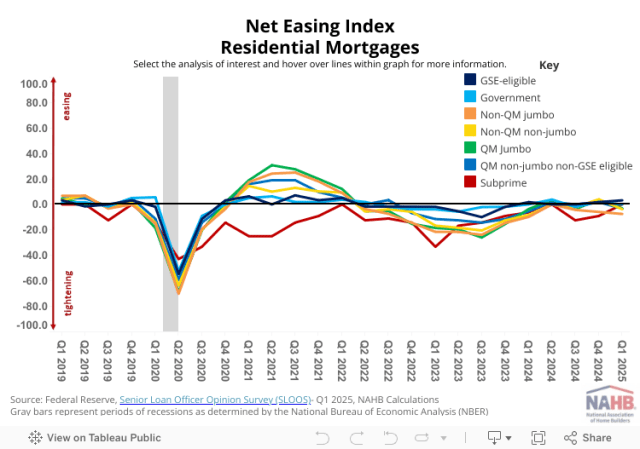

Eric Lynch2025-08-08T09:31:35-05:00In the second quarter of 2025, overall demand for residential mortgages was weaker, while lending standards for most types of residential mortgages were essentially unchanged1, according to the recent release of the Senior Loan Officer Opinion Survey (SLOOS). For commercial real estate (CRE) loans, lending standards for construction & development were modestly tighter, while demand was moderately weaker. However, for multifamily loans within the CRE category, lending conditions and demand were essentially unchanged for the third consecutive quarter. Last week, the Federal Reserve left its monetary policy stance (i.e., Federal Funds rate) unchanged for the fifth consecutive meeting, with Chairman Jerome Powell indicating in his statement that the Fed “is attentive to the risks to both sides of its dual mandate [maximum employment and inflation at the rate of 2%]” and the “uncertainty about the economic outlook remains elevated”. NAHB is still forecasting two interest rate cuts before the end of 2025. Residential Mortgages In the second quarter of 2025, five of seven residential mortgage loan categories saw a neutral net easing index (i.e., 0) for lending conditions. Only Qualified Mortgage (QM) non-jumbo non-GSE eligible loans experienced easing, as evidenced by a positive2 value (+1.8). Meanwhile, the only loans to experience tightening were non-QM non-jumbo loans at -2.0. Nevertheless, based on the Federal Reserve classification of any reading between -5 and +5 as “essentially unchanged,” all seven categories fell within this range. All residential mortgage loan categories reported at least modestly weaker demand in the second quarter of 2025, except for QM-jumbo which was essentially unchanged for the second consecutive quarter. Most notably, non-QM non-jumbo (-22.0%) and subprime (-20.0%) loans experienced significantly weaker demand during the quarter. The net percentage of banks reporting stronger demand for most of the residential mortgage loan categories has been negative for at least four years. Commercial Real Estate (CRE) Loans Across CRE loan categories, construction & development loans recorded a net easing index of -9.7 for the second quarter of 2025, indicating modestly tighter credit conditions. For multifamily loans, the net easing index was -4.8, or essentially unchanged. Both categories of CRE loans show tightening of lending conditions (i.e., net easing indexes below zero) since Q2 2022. However, the tightening has become less defined recently for multifamily, with its net easing index essentially unchanged (i.e., between -5.0 and +5.0) for three consecutive quarters. The net percentage of banks reporting stronger demand was -11.3% for construction & development loans and -3.2% for multifamily loans, with negative numbers indicating weakening demand. Like the trend for lending conditions, demand for multifamily loans has experienced unchanged conditions (i.e., between -5.0% and +5.0%) for three straight quarters. The Federal Reserve uses the following descriptors when analyzing results from the survey which will be used, in principle, within this blog post as well: – “Remained basically unchanged” means that the change or actual reading is greater than or equal to 0 and less than or equal to 5 percent. – “Modest” means that the change or actual reading is greater than 5 and less than or equal to 10 percent. – “Moderate” means that the change or actual reading is greater than 10 and less than or equal to 20 percent. – “Significant” means that the change or actual reading is greater than 20 and less than or equal to 50 percent. – “Major” means that the change or actual reading is greater than or equal to 50 percent.A value above zero (i.e., positive) indicates that lending conditions are easing while a value below zero (i.e., negative) indicates that lending conditions are tightening. Discover more from Eye On Housing Subscribe to get the latest posts sent to your email.