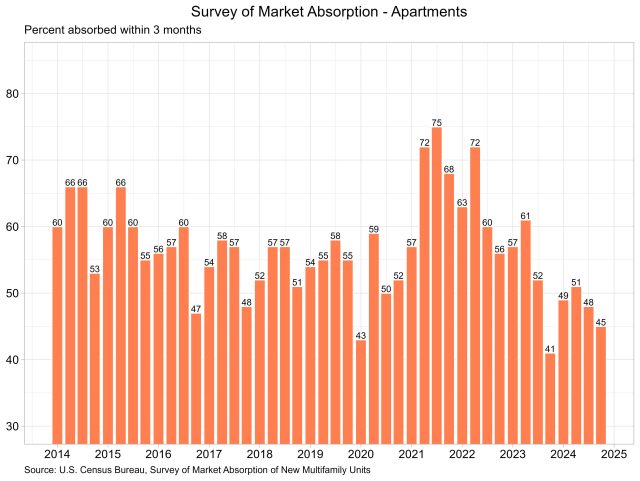

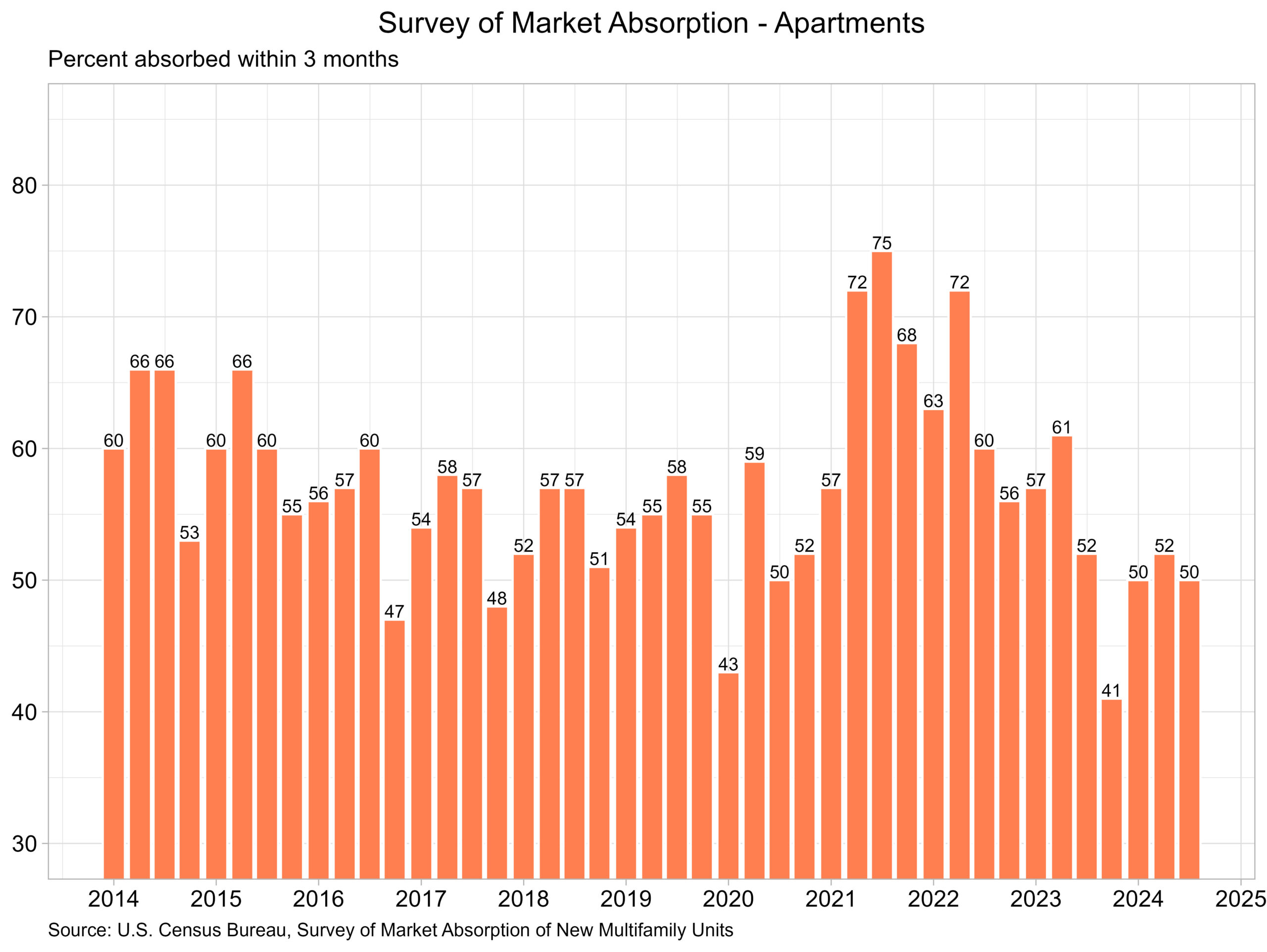

Multifamily Absorption Moves Lower for New Apartments

Jesse Wade2025-05-30T08:22:42-05:00The percentage of new apartment units that were absorbed within three months after completion continued to trend lower, according to the Census Bureau’s latest release of the Survey of Market Absorption of New Multifamily Units (SOMA). The survey covers new units in multifamily residential buildings with five or more units. The number of new multifamily units completed pulled back slightly in the fourth quarter of 2024 but remained elevated near historical highs after posting a third straight quarter of above 100,000 completions. Apartments The percentage of apartments absorbed within three months has fallen significantly from its peak of 75% in the third quarter of 2021, as shown in the graph above. Currently, the rate stands at 45%, coupled with 126,100 units completed in the fourth quarter of 2024. The large number of units completed each quarter continues to be a positive sign on the overall inflation front, as shelter inflation remains stubbornly high. More new apartments should help slow rent growth to lower levels in the coming months. Along with the three-month absorption rate and completions, SOMA reports absorption rates within six-months, nine-months, and 12-months of completion. Solely focusing on the 12-month absorption rate, it remained at its lowest level since the start of the pandemic, registering a rate of just 90%. This means that 10% of the 99,850 apartments completed in the first quarter of 2024 remain unoccupied a year after completion. Regional SOMA data indicates that apartments completed over a year ago remain unoccupied primarily in the Midwest (12%) and the South (12%). The Northeast reported only 2%, while the West reported 6%. Condominiums and Cooperative Units The 3-month absorption rate for new condominiums and cooperative units rose one percentage point up to 67%. Total completions of new condominiums and cooperative units, according to the SOMA, fell in the fourth quarter from 4,793 to 2,880. Completions of these units peaked in the second quarter of 2018 at 7,996 and has steadily fallen since then. Discover more from Eye On Housing Subscribe to get the latest posts sent to your email.