Volume of Residential Construction Loans Falls in Q4 2024

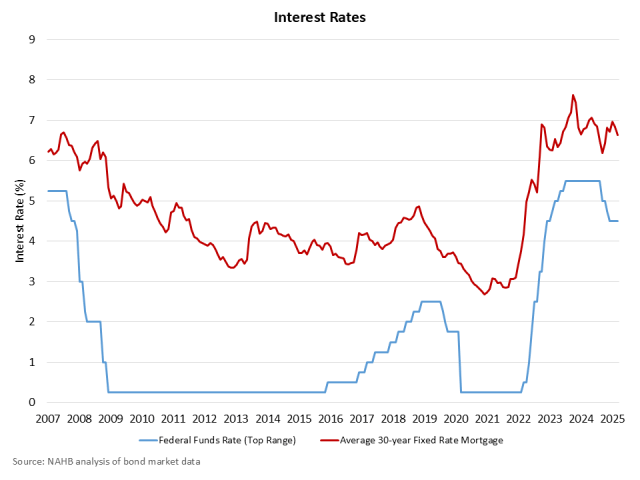

Jesse Wade2025-03-21T08:21:35-05:00Higher interest rates and tight financial lending conditions have led to a decline in loans for new home construction. The total volume of acquisition, development, and construction (AD&C) loans outstanding from FDIC-insured institutions fell 1.02% to $490.7 billion, the third straight quarterly decline. The level of 1-4 residential construction loans, which include loans for the construction of single-family homes and townhomes, has fallen for seven consecutive quarters. Coincidingly, the volume of 1-4 family residential construction has moved to its lowest level since 2021. The volume of 1-4 family residential construction and land development loans totaled $89.5 billion in the fourth quarter, down 7.6% from one year ago. This is also down after reaching a recent high of $105.0 billion in the first quarter of 2023. To end the year, a plurality of outstanding loans was held by smaller banking institutions, those with $1 billion-$10 billion in total assets, totaling $30.2 billion (33.7%). Banks with $10 billion- $250 billion in assets held the second largest share at $29.8 billion (33.3%), followed by the smallest banks with under $1 billion in assets, holding $20.7 billion (23.1%). The largest banks with over $250 billion in assets held the smallest amount at $8.8 billion (9.8%). Notably, 56.9% of 1-4 family residential construction and development loans were held by banks with under $10 billion in assets to end 2024. Small community banks play a vital role ensuring financial and lending opportunities for builders across the United States. The data below shows the year-ending level of outstanding 1-4 family residential construction loans broken out by bank asset sizes. All Other Real Estate Development Loans Excluding 1-4 family residential construction loans, the level of all other outstanding real estate construction loans totaled $394.6 billion and was down 2.2% from the previous year This is also down from a peak in the second quarter of 2024 of $404.2 billion. The banks that held the most loans were those with total assets between $10-$250 billion totaling $163.2 billion (41.4%) to end 2024. Banks with $1-$10 billion in assets held $107.1 billion (27.3%), banks with more than $250 billion in assets held $86.6 billion (21.9%) and the smallest banks, those with less than $1 billion in assets, held $37.7 billion (9.6%). For the end of 2024, larger banks ($10 billion or more in assets) had more activity in the other construction and land development loan arena compared to 1-4 family residential construction holding 63.3% of the outstanding volume. It is worth noting, the FDIC data represent only the stock of loans, not changes in the underlying flows, so it is an imperfect data source. Nonetheless, lending remains much reduced from years past. The current amount of existing 1-4 family residential AD&C loans now stands 56% lower than the peak level of residential construction lending of $204 billion reached during the first quarter of 2008. Alternative sources of financing, including equity partners, have supplemented this capital market in recent years. Discover more from Eye On Housing Subscribe to get the latest posts sent to your email.