Positive Momentum in Demand, Lending Conditions: Q1 2024 SLOOS

Eric Lynch

May 7, 2024

Federal Reserve,financing,lending,macroeconomics,mortgages,Other Housing Data,Senior Loan Officer Opinion Survey,sloos

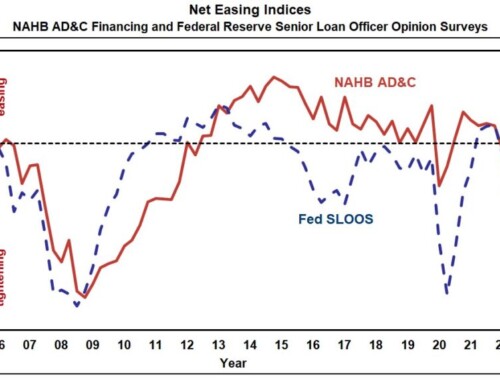

According to the Federal Reserve Board’s April 2024 Senior Loan Officer Opinion Survey (SLOOS), lending standards loosened further for all commercial real estate (CRE) loan categories and residential real estate (RRE) categories in the first quarter of 2024. While the Federal Reserve left the federal funds rate unchanged during their last meeting, demand for RRE and CRE loans saw marked improvement across all categories in the quarter.

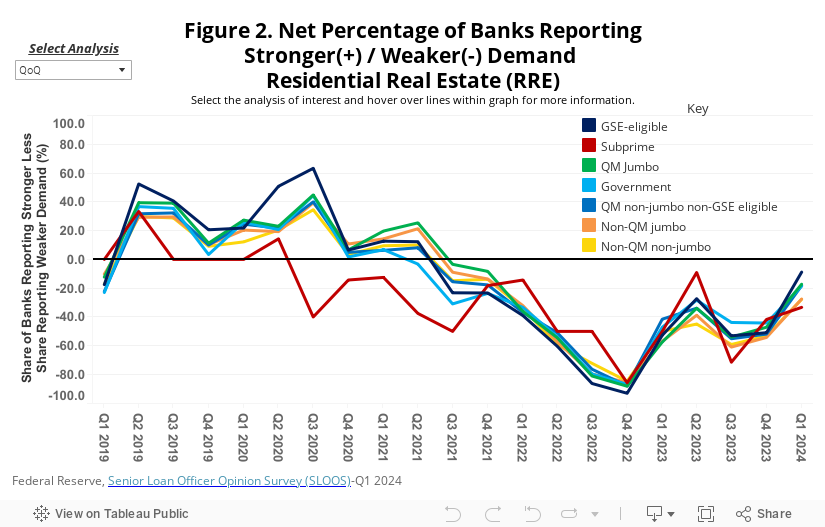

Residential Real Estate (RRE)

A higher net percentage of banks reported looser residential mortgage lending standards in Q1 2024 compared to Q4 2023 for all categories of RRE loans. For the second consecutive quarter, the largest improvement occurred for Qualified Mortgage (QM) jumbo which fell 11.8 percentage points (pp) from 15.4% in Q4 2023 to 3.6% in Q1 2024. GSE-eligible was the only RRE category which saw more banks reporting looser rather than tighter conditions, as evident by a negative reading in Q1 2024 (-1.8%). Government loans (i.e., issued by FHFA, Department of Veteran Affairs, USDA, etc.) saw a neutral reading where the number of banks reporting tighter and those reporting looser lending conditions was the same (0%).

All RRE categories but one (subprime) experienced a quarter-over-quarter increase of at least 25 pp in demand from Q4 2023 to Q1 2024, led by GSE-eligible loans improving 42.1 pp to -8.8%. On other hand, all RRE categories saw year-over-year double-digit percentage point increases from Q1 2023 to Q1 2024, with two categories increasing by at least 40 percentage points: GSE-eligible (+43.9 pp) and QM jumbo (+40.2 pp).

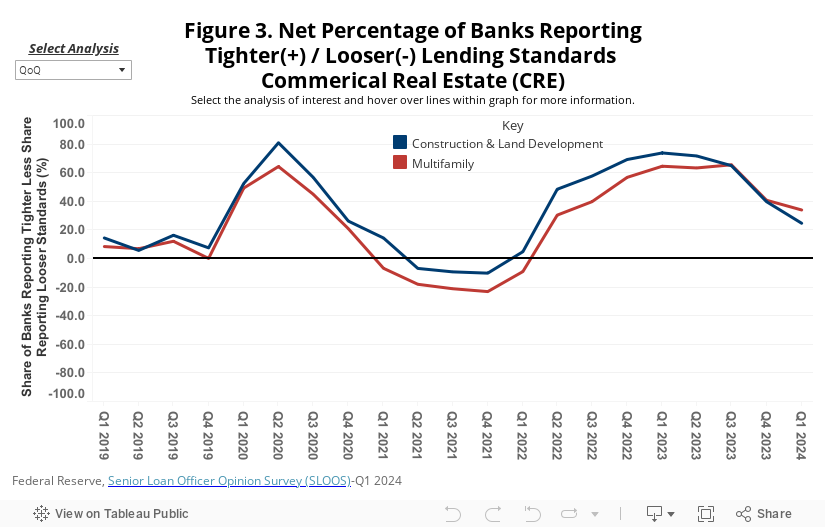

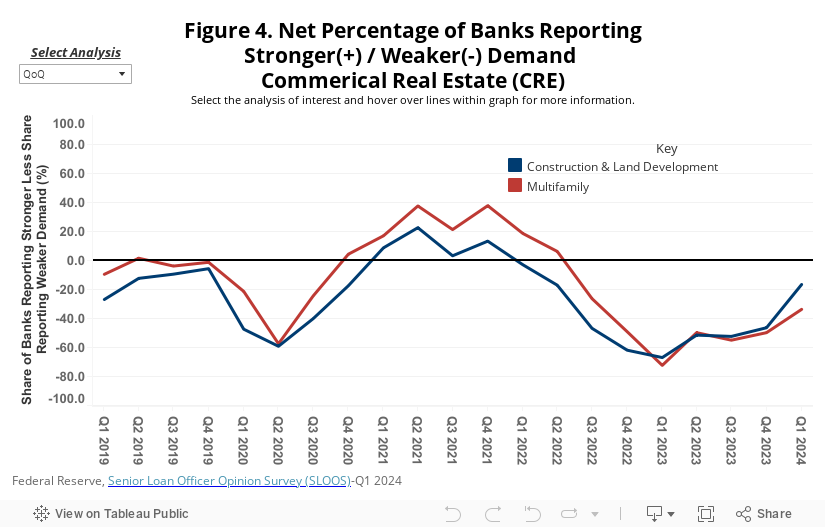

Commercial Real Estate (CRE)

Both multifamily as well as all CRE construction and development loans, on net, experienced a loosening of lending standards from Q4 2023 to Q1 2024. Construction & development experienced the share of banks reporting tightening conditions drop 15.1 pp to 24.6% while multifamily decreased by 6.8 pp to 33.9%. On a year-over-year basis, lending conditions for both construction & development (-49.2 pp) and multifamily (-30.6 pp) loosened substantially.

About a third of banks reported weaker demand for loans secured by multifamily properties compared to 16.7% for construction & development loans; this marked double-digit percentage point quarterly improvements for both loan types, led by construction & development (+29.9 pp). While demand continues to be negative, both construction & development (+50.5 pp) and multifamily (+38.7 pp) experienced large increases in activity year-over-year.

Discover more from Eye On Housing

Subscribe to get the latest posts to your email.