Inflation Picks Up in September

Web Master

October 24, 2025

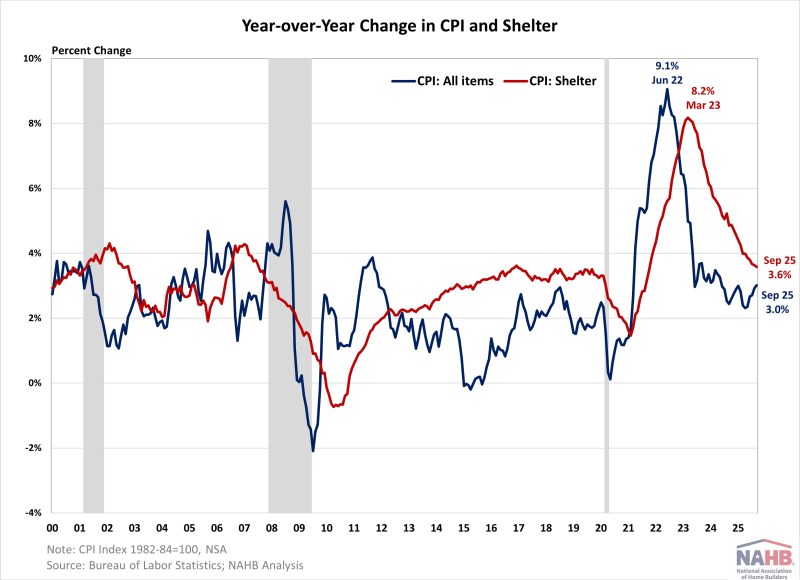

Inflation increased in September to the fastest pace since the start of the year, showing tariff pressure on prices continues to materialize gradually, according to the Bureau of Labor Statistics (BLS) latest report. This month’s data collection was completed prior to the government shutdown but was published this week in order to provide next year’s Social Security cost-of-living adjustments. Meanwhile, shelter inflation remained unchanged from last month and continued its downward trend, though it remains higher than pre-pandemic levels.

Though inflation is likely to remain elevated this year, the Fed is expected to continue easing given signs of labor market weakening. The housing market’s sensitivity to interest rates suggests rate cuts could help ease the affordability crisis and support housing supply even as builders continue to face supply-side challenges.

During the past twelve months, on a non-seasonally adjusted basis, the Consumer Price Index (CPI) rose by 3.0% in September, the highest reading since January 2025. Excluding the volatile food and energy components, the “core” CPI increased by 3.0% over the past twelve months. A large portion of the “core” CPI is the housing shelter index, which increased 3.6% over the year, the lowest reading since October 2021. Meanwhile, the component index of food rose by 3.1%, and the energy component index increased by 2.8%.

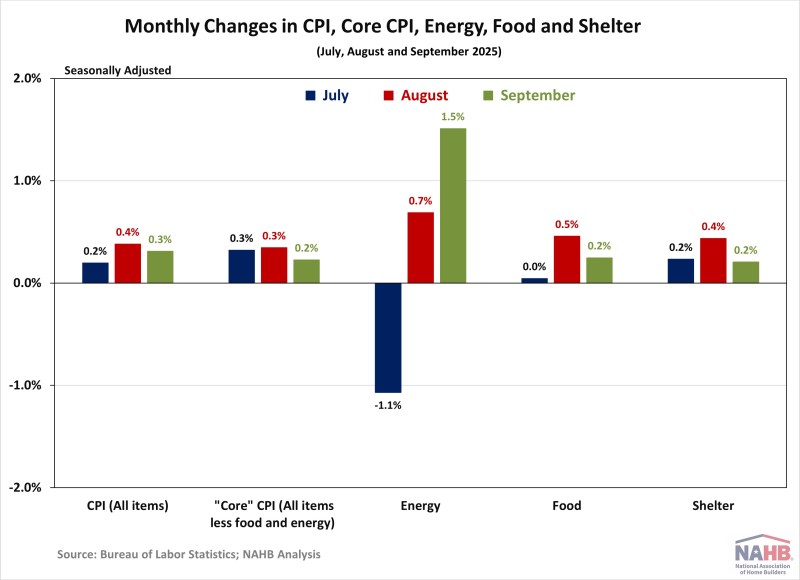

On a monthly basis, the CPI rose by 0.3% in September (seasonally adjusted), after a 0.4% increase in August. The “core” CPI increased by 0.2% in September, after a 0.3% increase in August.

The price index for a broad set of energy sources rose by 1.5% in September, as declines in natural gas (-1.2%) and electricity (-0.5%) were offset by increases in gasoline (+4.1%) and fuel oil (+0.6%). Meanwhile, the food index rose by 0.2%, after a 0.5% increase in August. The index for food away from home increased by 0.1%, and the index for food at home rose by 0.3%.

The index for gasoline (+4.1%) replaced shelter as the largest contributor to the overall monthly increase in all-items index. Other top contributors that rose in September included indexes for shelter (+0.2%), airline fares (+2.7%), recreation (+0.4%), household furnishings and operations (+0.4%) as well as apparel (+0.7%). Meanwhile, the index for motor vehicle insurance (-0.4%), used cars and trucks (-0.4%) and communication (-0.2%) were among the few major indexes that decreased over the month.

The index for shelter, which makes up more than 40% of the “core” CPI, rose by 0.2% in September, following a 0.4% increase last month. The index for owners’ equivalent rent (OER) rose by 0.1% and index for rent of primary residence (RPR) increased by 0.2% over the month.

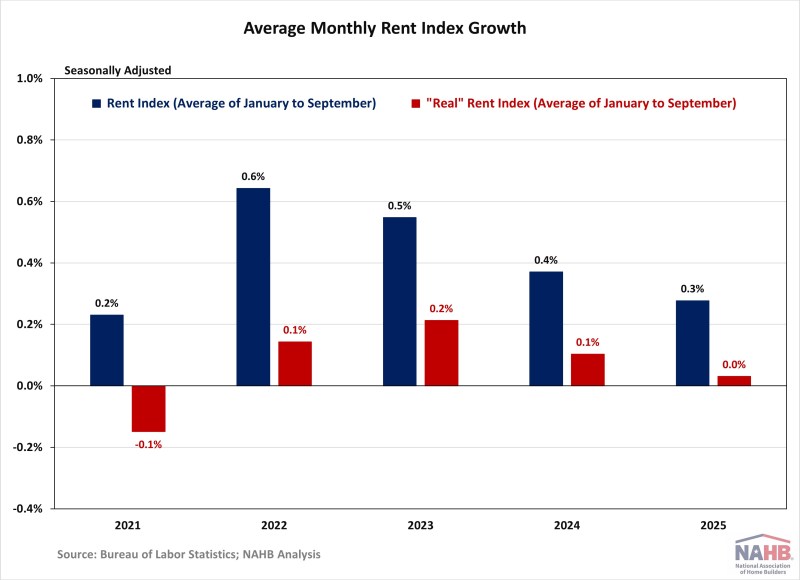

NAHB constructs a “real” rent index to indicate whether inflation in rents is faster or slower than core inflation. It provides insight into the supply and demand conditions for rental housing. When inflation in rents is rising faster than core inflation, the real rent index rises and vice versa. The real rent index is calculated by dividing the price index for rent by the core CPI (to exclude the volatile food and energy components).

In September, the Real Rent Index remained unchanged. Over the first nine months of 2025, the average monthly growth rate remained flat at 0.0%, slower than the average of 0.1% in 2024.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.