Mortgage Rates Continue to Trend Lower in November

The average mortgage rate in November continued to trend lower to its lowest level in over a year. According to Freddie Mac, the 30-year fixed-rate mortgage averaged 6.24% in November, 2 basis points (bps) lower than in October. Meanwhile, the 15-year rate increased 3 bps to 5.51%. Both the 30-year and 15-year rates remain lower than a year ago, dropping by 57 bps and 52 bps year-over-year, respectively.

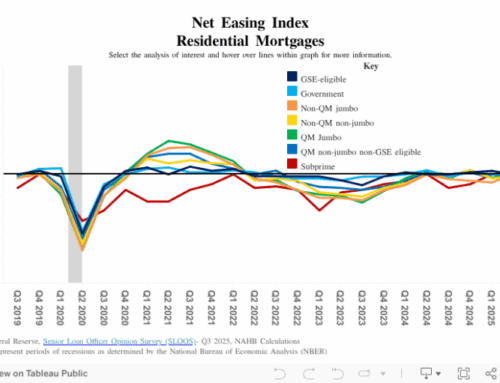

The 10-year Treasury yield, a key benchmark for long-term borrowing, averaged 4.09% in November– a 3-basis point increase from the previous month. The spread between the 30-year fixed mortgage rate and the 10-year Treasury remains somewhat elevated at 215 basis points, well above the roughly 150-180 basis points seen in a stable market. While the spread has narrowed from the wide gap in 2023, it continues to reflect ongoing market uncertainty, keeping mortgage rates higher than their historical relationship to 10-year Treasury yields.

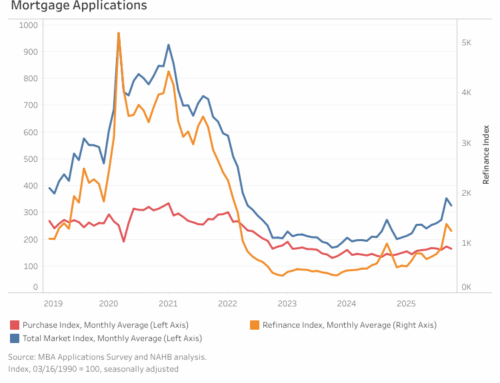

Falling mortgage rates have shown some impact on housing activity. Mortgage application activity continues to strengthen, led by increases in adjustable-rate mortgages and refinancing applications. Additionally, existing home sales rose to an eight-month high in October. There is no data available for new home sales in October due to the government shutdown.