Household Real Estate Asset Values Reach New High

Web Master

September 12, 2025

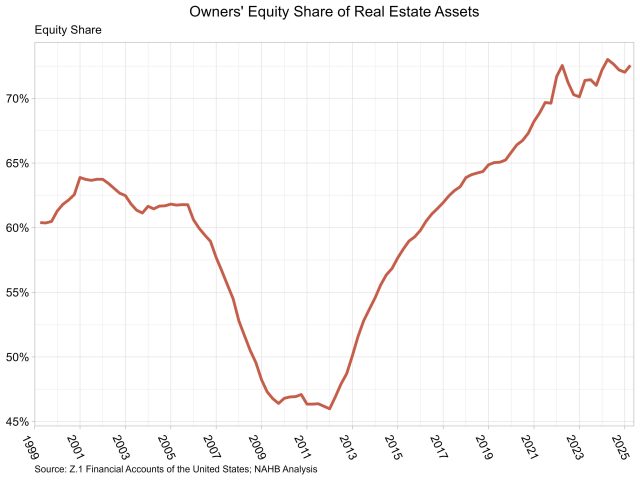

The market value of household real estate assets rose to $49.3 trillion in the second quarter of 2025, according to the most recent release of U.S. Federal Reserve Z.1 Financial Accounts. The value rose by 2.7% from the first quarter and is 1.1% higher than a year ago. This measure of market value estimates the value of all owner-occupied real estate nationwide. The calculation combines both repeat-home sales data with estimates of additions to the housing stock, essentially measuring both price changes and the change in quantity of housing assets. This approach helps explain why household real estate wealth can continue to rise even as other measures may show a slowing in home price growth.

Real estate secured liabilities of households’ balance sheets, i.e. mortgages, home equity loans, and HELOCs, increased 0.8% over the second quarter to $13.5 trillion. This level is 2.8% higher compared to the second quarter of 2024.

Owners’ equity share1 of real estate assets was 72.6% in the second quarter, marking an increase in owners’ equity share from the first quarter. The share in the second quarter of 2024 was 73.0% and has been above 70% for 14 consecutive quarters, the longest stretch since the 1950s. Owners’ equity in real estate was $35.8 trillion in the second quarter.

- Owners’ equity as a percentage of household real estate; Difference between assets and liabilities as a share of assets

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.