Mortgage Activity Remains Lower Midway Through Spring Buying Season

Per the Mortgage Bankers Association’s (MBA) survey through the week ending May 3rd, total mortgage activity increased 2.6% from the previous week, and the average 30-year fixed-rate mortgage (FRM) rate fell 11 basis points to 7.18%. The 30-year FRM has risen 17 basis points over the past month as rates remained at around seven percent for the fifth consecutive week.

The Market Composite Index, a measure of mortgage loan application volume, rose by 2.6% on a seasonally adjusted (SA) basis from one week earlier after falling the two weeks prior. Week-over-week, both purchasing and refinancing activity rose with purchasing activity increasing 1.8% and refinancing activity increasing 4.5%.

Despite both the purchase and refinance indexes increasing over the week, both remained below 2023 levels. The purchase index was down 17.0%, while the refinance index was down 5.8% from a year ago.

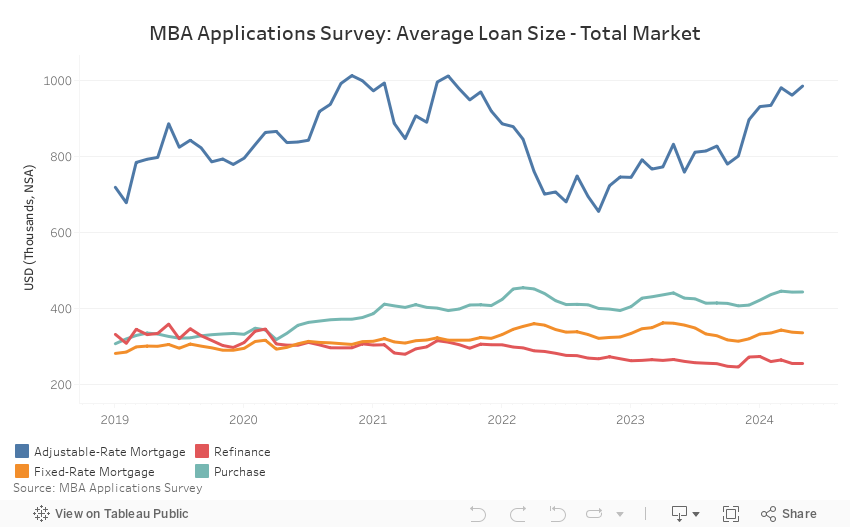

The refinance share of mortgage activity rose from 30.2% to 30.6% over the week, while the adjustable-rate mortgage (ARM) share of activity fell from 7.8% to 7.7%. The average loan size for purchases was $443,200 at the start of May, up from $442,800 over the month of April. The average loan size for refinancing decreased from $255,300 in April to $255,100 in May. The average loan size for an ARM was up at the start of May to $984,500, while the average loan size for a FRM fell to $335,800.

Discover more from Eye On Housing

Subscribe to get the latest posts to your email.